Indian Railways: Riding High

Sustained budgetary capital outlay and growing freight demand are pushing Railways to new highs.

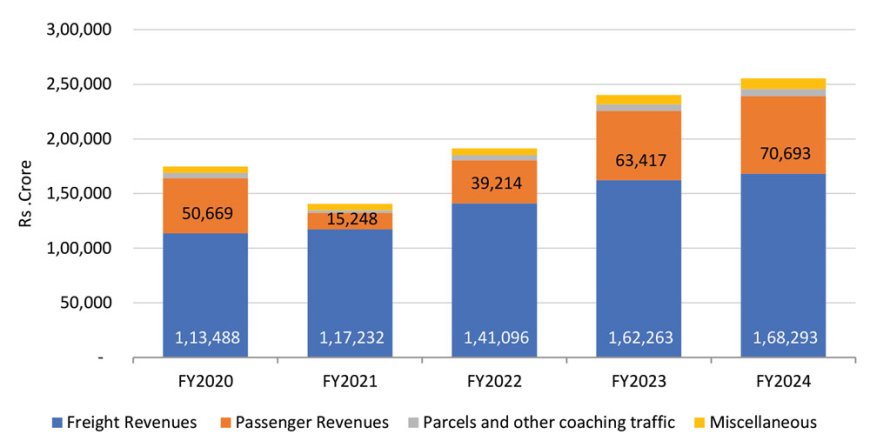

Sustained budgetary capital outlay and growing freight demand are pushing Railways to new highs. Over the past five years, the total revenues for the Indian Railways have grown at a CAGR of 10% to Rs. 2,55,366 crore in FY2024 from Rs. 1,74,661 crore in FY2020. During this period, freight revenues (which account for ~65% of revenues in FY2024) have grown at a CAGR of 10.4% to Rs. 1,68,293 crore in FY2024 from Rs. 1,13,488 crore in FY2020. The CAGR volume growth in tonnage for Railways was around ~6% during the last five years, which helped the Indian Railways to improve its share in freight logistics to ~30% currently, and the same is expected to further go up in the medium to long term. Various factors contributed to the growth in freight volumes - a sustained increase in coal transportation, diversification of goods being transported (including cement, fertilisers, containerised shipments, parcels etc.) and infrastructure investments, notably the dedicated freight corridors, which have improved capacity and efficiency.

At the same time, there has also been a sustained increase in passenger revenues during the five-year period from FY2020-2024, with receipts growing at a CAGR of 9% to Rs. 70,693 crore in FY2024 from Rs. 50,669 crore in FY2020. The consistent focus on improvement in passenger amenities and safety, coupled with a focus on digitalisation and rationalisation of subsidised fares has contributed to this growth. Further, Government initiatives such as the introduction of tourist circuit trains named ‘Bharat Gaurav’, the introduction of the ‘Vande Bharat’ trains, undertaking of major suburban rail projects, which improved connectivity and convenience – all have added to passenger confidence and trust in the Indian Railways, which has boosted passenger volumes and revenues.

Exhibit 1: Trend in passenger and freight revenues

Source: Ministry of Railways Annual Reports, Amounts. In Rs. Crore

Growth in capex

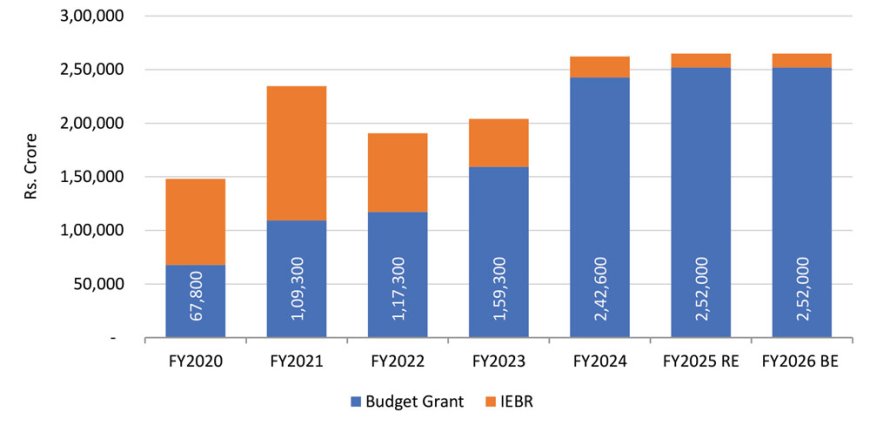

The capital expenditure by the Ministry of Railways (MoR) has doubled in the last five years. Over the years, the Government of India has implemented several measures and made sizeable investments in transportation infrastructure to improve logistics cost, reduce transit time, and improve connectivity. There has been a sustained focus on improving railway infrastructure (track infrastructure and safety standard) and passenger experience (station amenities and rolling stock), as is evident from the continued healthy allocation in the budgetary outlay. Overall, the capital outlay for the Indian Railways has increased by 130% over the previous five years to reach Rs. 2.52 lakh crore in FY2026BE. However, in the last two years, the budgetary support has grown by a modest 2% (FY2024-FY2026BE).

Exhibit 2: Railways’ capex outlay has almost doubled in last five years

Source: ICRA Research; Budget documents, Amounts. in Rs. crore

Extra Budgetary Resources (Special) (EBR-S) by Indian Railway Finance Corporation (IRFC) of Rs 50,515 crore during FY2021 resulted in spike in overall IEBR funding

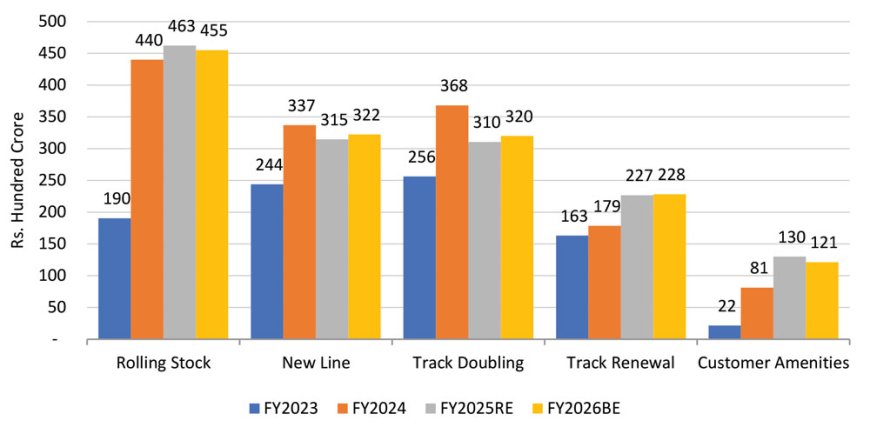

Historically, track-infrastructure has accounted for a major share of the capital outlay; however, the investments in rolling stock and modernising of railway stations have also witnessed a handsome growth in recent years. These are in line with the Government’s broader objective of improving the efficiency and safety of the Indian Railways. The focus on track infrastructure will enable the decongestion of the existing network, reduce bottlenecks and support capacity expansion for both passenger and freight movement. Investments in rolling stock and station re-development will enhance safety and comfort, while increasing the Indian Railway’s overall passenger appeal compared to other modes of transport.

Exhibit 3: Capital outlay across multiple sub-heads in Railways

Source: ICRA Research; Budget documents, Amounts in Rs. hundred crore

Trend in capital outlay

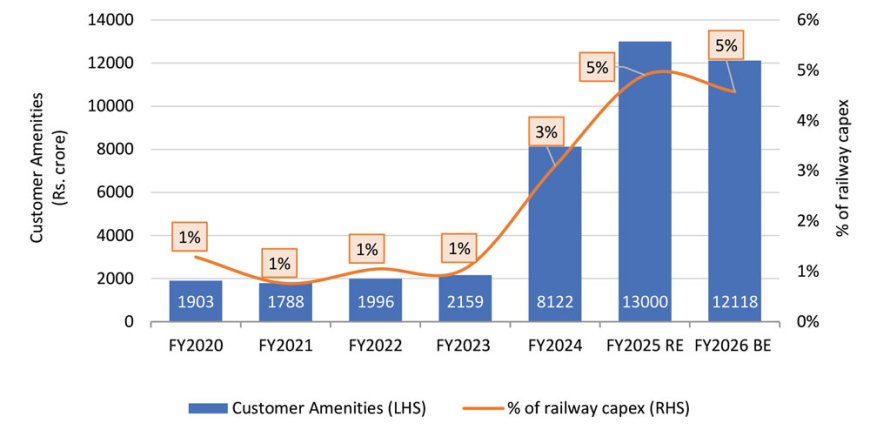

Outlay towards customer amenities witnessed a sharp growth in last three years, albeit on a lower base. With almost 95% of railway tracks electrified, safety-related enhancements along with station modernisation are the next key focus areas for the Railways. Development of stations and provision of passenger amenities, including station redevelopment under the Amrit Bharat Station Scheme (ABSS) are funded under the ‘Customer Amenities’ section in the Railway Budget. The allocation under the customer amenities (including station redevelopment works) increased by more than 6 times from Rs. 1,903 crore in FY2020 to Rs. 12,118 crore in FY2026BE, which is also reflected in the increase in project awards and execution as per Exhibit 4.

Exhibit 4: Growth in budgetary allocation under customer amenities

Source: ICRA Research; Budget documents, Amounts. In Rs. crore

Benefit to contractors

Several mid-sized contractors emerged as key beneficiaries of Railway station redevelopment projects. The station development programme was approved by the Union Cabinet in 2015 with a plan to develop the requisite infrastructure under the Public Private Partnership (PPP) mode; however, it witnessed slow progress in this mode initially, given the limited track record of PPP in Railways, restriction on pricing and market risk for real estate development. With limited success in the PPP mode, the Government of India (GoI) shifted to the engineering, procurement and construction (EPC) mode and the order-awarding has picked up pace in the past three years.

The Indian Railways has around 8,477 railway stations of which about 1,318 are being considered for redevelopment under the Amrit Bharat Station Scheme. Foundation stones have been laid for 553 stations and another 765 are pending redevelopment, which provides sizeable opportunity for players in the construction segment. Of the 1,318 stations slated for this project, the Rail Land Development Authority (RLDA) will be developing 101 stations (14 in PPP mode and balance 87 in EPC), whereas zonal railways will develop the remaining 1,217 stations (all under the EPC mode).

The awarded stations (553) are being redeveloped at a cost of over Rs. 25,000 crore. Majority of the contracts bid out till date were in the range of Rs. 500-Rs. 1,500 crore and benefitted several mid-sized EPC players. Of the awarded stations, five are operational - Rani Kamlapati (Habibganj, Bhopal) under the PPP mode and Gandhinagar (Gujarat), Gomtinagar (Phase 1), Sir M. Visvesvaraya Terminal (Bengaluru) and Ayodhya Dham under the EPC mode.

Estimated opportunities in station redevelopment

As per ICRA estimates, the overall opportunity in station redevelopment (for balance 765 station) for the EPC players is expected to be more than Rs. 30,000 crore over the next two years (FY2026-FY2027). Bidding is expected to be completed by FY2026, and with work completion likely over the medium term. Majority of these awards are expected to be bid out in the EPC mode, given the low participation from the private players for PPP projects. The estimated cost of redevelopment of major stations (~13), with contract value of more than Rs. 500 crore under the RLDA phase 1, is likely to be around Rs. 17,000 crore.

Challenges in station redevelopment

Given that urban transport and development comes under the state jurisdiction, lack of coordination, coupled with clearances, along with proper resource management hinders timely project execution. Further, execution work has to be undertaken with running traffic and trains operating simultaneously, which also impacts progress. Although the DPRs (Detailed project report) are available, the detailed designs and drawings need to be approved in a timely manner for faster project execution.

Stable outlook for Railways

According to ICRA’s analysis, the entities catering to the requirement of rolling stock/wagons, track infrastructure, electrification and safety components have witnessed a healthy compounded annual growth rate (CAGR) of 24% over the three years ending in FY2024. However, the revenue growth of ICRA’s sample entities, catering to the Railway sector is likely to witness relatively flattish growth in FY2025e and FY2026e. The weighted average margins are expected to continue to remain healthy at around 12% for FY2026, supported by operating leverage benefits and expectations of stable input prices. The revenue profile for the entities in the sector is likely to be driven by the EPC and wagon manufacturing companies, given the bulky nature of the projects they undertake, though the margin profile for the sector will be mainly supported by service-oriented entities related to ticketing and logistics. While competition in the Railways has increased substantially in recent years, especially in the EPC segment, the credit profiles of entities catering to the Indian Railways will continue to benefit from the operating leverage and the comfortable receivable cycle.