NCR's real estate market outlook remains optimistic with sustained growth expected in the medium to long term.

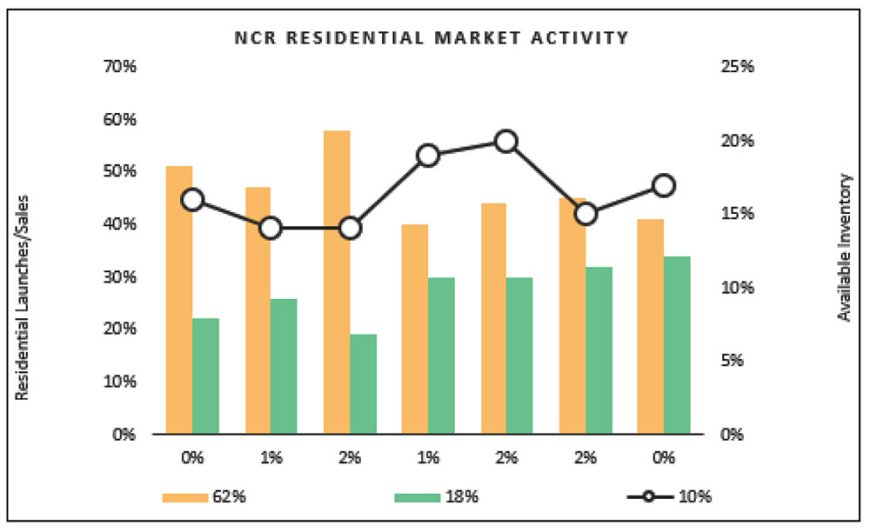

Approximately 211,700 new residential units were launched between 2019 and Q1 2025 in NCR. Housing demand has outpaced supply with the absorption of 313,900 units, leaving only 84,500 units available for sale by the end of Q1 2025.

What are the major market trends in the north India real estate market?

Approximately 211,700 new residential units were launched between 2019 and Q1 2025 in NCR. Housing demand has outpaced supply with the absorption of 313,900 units, leaving only 84,500 units available for sale by the end of Q1 2025. The year 2024 marked a particularly significant milestone with record-high new supply levels. This trend indicates a healthy market dynamic where increasing supply is being met with even stronger absorption rates, steadily reducing available inventory.

Average property prices across NCR have appreciated by 82% between 2019 and Q1 2025, with the current (Q1 2025) average property price of NCR standing at Rs 8,330/sf. Among all the zones of NCR, Greater Noida, Noida and Gurugram witnessed the highest price appreciation of 98%, 92% and 84% respectively.

How is the demand trend in residential and commercial segments?

The residential segment is witnessing strong demand fundamentals from both end-users and investors. Gurugram dominates the NCR market with 143,500 units absorbed between 2019 and Q1 2025, representing 46% of the region's total absorption.

|

Zone |

Gurgaon |

Noida |

Greater Noida |

Ghaziabad |

Faridabad |

Delhi |

Bhiwadi |

|

Housing Absorption in Units (2019-Q1 2025) |

1,43,500 |

33,900 |

66,500 |

39,200 |

14,800 |

9,600 |

6,300 |

|

% Share of NCR Absorption |

46% |

11% |

21% |

13% |

5% |

3% |

2% |

The commercial office market has shown resilience and growth, particularly after recovering from the pandemic-induced slowdown in 2020. Net office absorption in NCR reached 9.5 Mn sf in 2024, surpassing the pre-pandemic level of 8.6 Mn sf in 2019. Flexible workspaces/Co-working providers have emerged as a dominant force in the Grade-A office leasing market, capturing a 34% share in 2024, reflecting the evolving workplace preferences in the post-pandemic era.

|

NCR |

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Net Office Absorption (Mn sf) |

|

8.6 |

2.8 |

4.65 |

6.4 |

5.90 |

9.5 |

What are the factors that propel the growth of real estate market in the region?

Growth in NCR's real estate market can be attributed to several key factors. Infrastructure development, particularly the development of industrial corridors, expansion of metro networks and expressways, has significantly enhanced connectivity across the region, making previously peripheral areas more accessible and attractive.

The pandemic-induced shift toward larger living spaces and work-from-home arrangements has catalysed demand for spacious residential units with dedicated workspaces. Additionally, rising disposable incomes among the region's expanding middle class and the growing presence of multinational corporations establishing offices in NCR have further stimulated both residential and commercial real estate demand.

What are the challenging factors prevailing for the real estate market?

Despite its robust performance, the NCR real estate market faces several challenges. Rising construction costs due to inflation in raw material prices are squeezing profit margins for developers and potentially affecting affordability for end-users. Regulatory complexities and approval delays continue to hamper project timelines and increase carrying costs. Environmental concerns, particularly around water scarcity and pollution levels in the region, pose sustainability challenges for large-scale developments.

Additionally, global economic uncertainties might affect foreign investment flows into the commercial real estate segment. Land acquisition difficulties and escalating land costs in prime areas also represent significant hurdles for new project launches.

What is your market outlook for real estate in northern region? What are your plans for the coming years?

The outlook for NCR's real estate market remains optimistic with sustained growth expected in the medium to long term. The residential segment is likely to maintain its momentum, with luxury and ultra-luxury segments gaining traction as wealth creation continues among high-net-worth individuals. Integrated township developments offering live-work-play environments are projected to attract significant interest from both end-users and investors. The commercial office market is expected to evolve further with hybrid work models driving demand for flexible workspaces and technology-integrated office environments.