The roads & highways sector is expected to witness higher construction activity in FY2025.

Vinay Kumar G

Vice President & Sector Head - Corporate Ratings, ICRA Limited

Government has set a target of 2 lakh km NH network by 2037. How do you compare the goal and the progress of the highway projects in India?

The length of national highways (NH) in the country has increased by around 60% to 1,46,145 km as of November 2023 from around 91,287 km from 2014.

|

|

Length (in km) |

Length (in lane km) |

||||

|

Length (in km) |

2014 |

Nov'2023 |

Growth % |

2014 |

Nov'2023 |

Growth % |

|

<2L# |

27517 |

14870 |

-46% |

27517 |

14870 |

-46% |

|

2L+PS# |

45399 |

85096 |

87% |

90798 |

170192 |

87% |

|

4L and above# |

18371 |

46179 |

151% |

73484 |

184716 |

151% |

|

Total length/lane km (minimum) |

91,287 |

146,145 |

60% |

205,558 |

377,213 |

93% |

# Assuming lane km as 1, 2 and 4 for <2L, 2L+PS and 4L and above respectively

Source: MoRTH, NHAI, ICRA Research

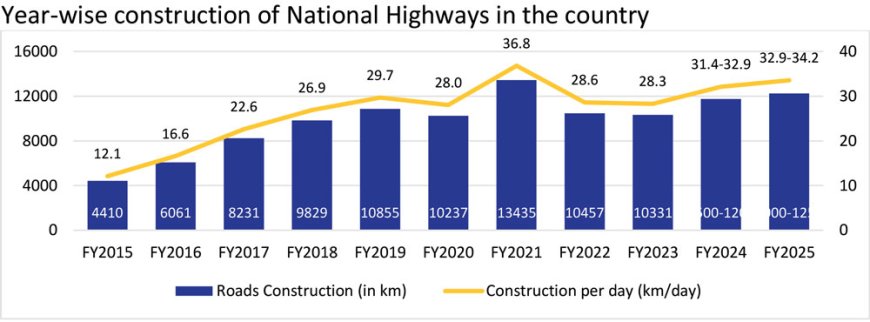

From FY2015 to FY2024, the ministry has constructed more than 95,000 km and is a combination of both greenfield and brownfield expansions. While greenfield construction adds to the length of the highways, brownfield expansions, including conversion of 2-lane to 4-lane and 4-lane to 6-lane, do not increase the length of national highways. Nonetheless, in terms of lane kms, length of national highways has increased by a higher proportion of 93% during the above period as compared to 60% increase in the highway length in km.

Government of India has set a target of increasing the length of national highways to 200,000 km by 2037 and simultaneously increase the length of access-controlled highways by more than 12 times to 50,000 km from the current 4,000 km.

With strong focus of the government on improving the road infrastructure, the target of the ministry to increase NHs length to 200,000 km by 2037 entails construction of around 53,000 km over the next 13 years. Given the progress achieved in the last 10 years with road construction of more than 95,000 km over the past 10 years, the target seems achievable. Further, the ministry plans to increase the length of access-controlled roads which are in general 6-lane or 8-lane highways. Going forward, majority of the greenfield highways are planned as 4-lane or 6-lane or 8-lane roads with land acquisition being done currently for future lane expansions.

Further, the ministry has taken many steps over the past decade for the improvement in road construction such as road execution through widely accepted models including HAM, higher budgetary allocation, resolution of RoW issues and other approvals for faster on-ground execution, relaxation of performance security of the developers during Covid-19 pandemic among others. The allocation to Ministry of Road Transport and Highways (MoRTH) has increased from Rs 0.31 lakh crore in FY2014 to Rs 2.72 lakh crore in FY2025 BE (CAGR growth of 22%), signifying the importance given by the Central Government to road development. With continued focus on the Central Government on developing road infrastructure, the target is likely to be achieved.

The Interim Budget 2024 has allocated significant funds for roads and highways for the year 2024-25. How do you look at the opportunities for contractors in the year ahead?

The growth in budgetary allocations is modest at 3% YoY during FY2025BE; however, the overall budgetary supports remain healthy at Rs 2.72 trillion in FY2025BE. The ministry is expecting increasing share of BOT-TOLL projects in FY2025, which will entail relatively lower funding support from the government as compared to EPC or HAM.

Allocation to the road sector remained healthy so that the completion targets for the Bharatmala Pariyojana and the National Infrastructure Pipeline (NIP) can be met. The ministry is likely to complete road construction of around 11,500-12,000 km in FY2024 and ICRA expects the execution to grow by 5-8% to 12,000-12,500 km in FY2025.

The awards from MoRTH are likely to decline by 47-42% YoY to around 6,000-6,500 km in FY2024 compared to 12,375 km in FY2023, mostly on account of low awarding activity in 11M FY2024 amid delay in approval for revised cost estimates of Bharatmala Pariyojana Phase 1 (BMP) and muted project awarding in Q4 FY2024, ahead of the General Elections. However, ICRA expects the MoRTH awards to be around 10,000-10,500 in FY2025 with likely revival in the awarding activity post the General Elections with more than 40,000 km of highways which have been identified but yet to be awarded including pending 8,000 km of Bharatmala Pariyojana Phase-I.

Although awarding activity in FY2024 is low, it is unlikely to impact the pace of execution on the back of healthy unexecuted order book of awards and continued higher outlay to road ministry.

How do you look at the key challenges in roads & highways sector?

The key challenges in the roads & highways sector include:

Land acquisition: Delay in land acquisition is one of the major factors adversely affecting the timely implementation of highway projects in the country. Further, the cost of land acquisition has increased significantly, post the amendments to the Land Acquisition act in 2013. As per the ministry, average cost of land acquisition was about Rs 80 lakh/hectare before 01.01.2015, which has gone up to about Rs 3.60 crore/hectare as of December 2018 and has further gone up in the recent years. Over the past five years (around FY2019-FY2023), NHAI has spent Rs 1.67 lakh crore on land acquisition compared to Rs 0.81 crore during FY2015-FY2018.

Approvals and permissions: While Right of Way (ROW) of 80% is a pre-requisite for declaration of the appointed date, other issues relating to forest and environment clearances, permissions and approvals related to railways, power, pipelines and shifting of existing utilities are also result in delays in the construction of roads.

Significant increase in competitive intensity: The roads & highways sector has attracted many developers and the competitive intensity in the sector has intensified further in the last three years, which is reflecting in several projects awarded at significant discount to authority’s base price. Given the sizeable discounts on the bids for the projects awarded by the authority, ability of the contractors to execute these projects within budget and in a timely manner remains critical. Further, ability of the contractors to bring in equity and tie-up required debt for the development projects under Hybrid Annuity Model (HAM) remains crucial for timely implementation of the projects.

Alternate routes and alternate modes of transport: Alternate routes and alternate modes of transport pose huge threat in terms of shift of traffic from the existing routes to new routes/new modes of transportation. The development of greenfield highways and expressways with focus on shortest path between origin and destination is transforming the road network in the country and is likely to compete with the old network of roads. Further, alternate mode of transport including Dedicated Freight Corridor (DFC) and Regional Rapid Transport System (RRTS) are expected to pose threats to the existing road network in the country.

What is your outlook on the roads and highways sector in India?

ICRA has a ‘stable’ outlook on the roads and highways sector in India. For the toll road entities in the sector, the overall traffic volume is likely to see a YoY growth of 4-5% in FY2025, while the toll rate hike is expected to be relatively modest at 1-3.3% in FY2025 against 1.4-5.0% in FY2024, resulting in toll collections growth of around 5-8%. The Operations & Maintenance expenses to remain stable on account of relatively stable commodity prices (as compared to past trend), especially bitumen.

For entities in HAM segment, since the interest on annuities in HAM assets are linked with the RBI’s repo rate, and with ICRA’s expectation of extended pause in policy rates through H1 FY2025, the coverage metrics for HAM projects are likely to remain Stable in FY2025.

With strong order book and significant allocation of funds in the budget, the sector is expected to witness higher construction activity in FY2025. The road execution is likely to be around 12,000-12,500 km in FY2025 compared to 11,500-12,000 km in FY2024.

Graph

Year-wise construction of National Highways in the country

Source: ICRA Research, MoRTH, NHAI; * includes construction of both greenfield and brownfield NH roads in the country.