INDIAN CEMENT INDUSTRY: BUILDING THE FUTURE

India's infrastructure sector is essential to the nation's economic development because it encourages the growth of numerous other industries, including construction and real estate.

Cement production is aided by the expanding construction sector, which in turn benefits from the growing demand for urban living. Provision of utilities, building of roads, building of bridges and dams, and upgrading of metropolitan facilities are all included in the infrastructure sector. The cement industry plays a pivotal role in accomplishing these and additional goals.

The cement industry has performed fairly well recently among the eight core industries. In recent years, the cement industry has experienced a number of institutional and non-institutional peaks and troughs, but it has persevered with strong capacity expansions.

The National Council for Cement and Building Materials (NCCBM) projects that by 2025, the cement sector in India will have added about 80 million tonnes of capacity. After China, India is the world's second-largest producer of cement, with 298 million tonnes (FY 2022).

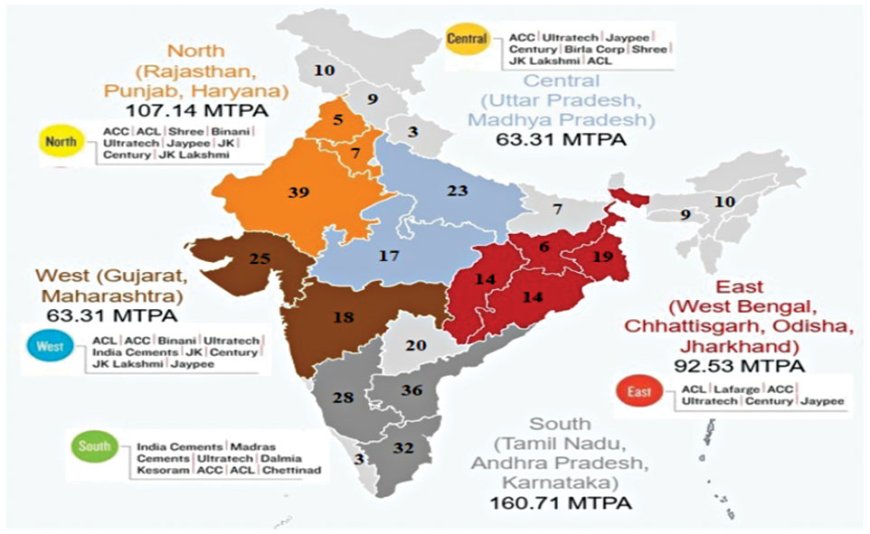

Its installed capacity for the production of cement accounts for 8% of the global total. It has 210 sizable cement plants in total, 77 of which are located in the states of Tamil Nadu, Rajasthan, and Andhra Pradesh. In 2022, the cement market in India accounted for 3,644.5 million tonnes. The industry aims to grow at a compound annual growth rate (CAGR) of 4.94 percent from 2023 to 2028, or 4,832.6 million tonnes.

The cement industry in India is closely related to a number of other industries, including steel, coal, power, housing, construction, infrastructure, and transportation. It plays a major part in carrying out a number of government flagship projects, including the clean India mission, ultra-mega power projects, concrete highways, dedicated freight corridors (DFCs), housing for all, smart cities and waterways.

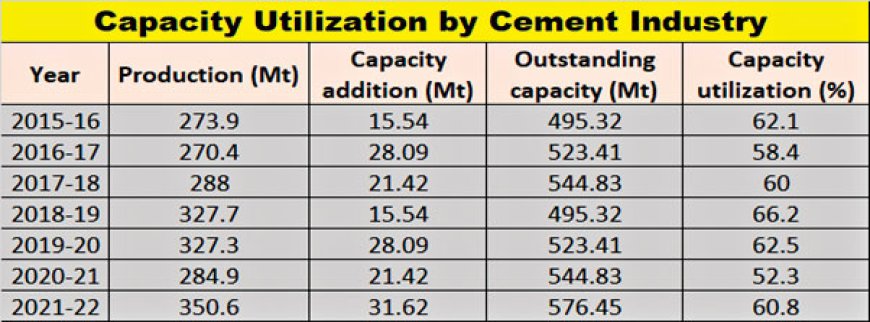

Installed capacity and utilization of capacity in Indian cement production

India, the world's second-largest cement producer after China, accounts for more than 8% of the installed capacity worldwide in the cement production industry. India possesses potentially abundant limestone deposits in various regions, which are essential for the production of cement.

With respect to installed capacity, the South of India accounts for 33% of the country's cement production market share, with the North, East, West, and Central regions following at 22%, 19%, and 12%, respectively.

In 2022–2023, an additional 21.2 million tonnes per annum (mtpa) of manufacturing capacity was predicted for the cement industry. Projects estimated to cost Rs 71.8 billion were anticipated to be put into service during that time. This would have been the fourth year in a row that the industry increased its manufacturing capacity by more than 20 million metric tonnes per year. The industry added a total of 81.1 mtpa of manufacturing capacity between 2019-20 and 2021-22.

The capacity utilisation of cement industries decreased from 66.2 per cent in 2018-19 to 60.3 per cent in 2021-22. There was contraction in demand and production during the pandemic. Now the industry is showing resilience by getting out of the slump and developing rapidly.

Consumption & manufacturing

Consumption: In 2022-23, it was predicted that India would consume more than 370 million tonnes of cement overall. It was anticipated that domestic consumption would total 373.1 million tonnes in the year, up 6.3% from the year before. The first half of FY 2023 saw a 10% increase in consumption, which was quite good.

Manufacturing: Several types of cement are produced by cement manufacturers in India, including Portland, PPC, blended, fly ash, high strength, marine technology, slag-based, silica-based, and high alumina cement.

Overall, the domestic production of cement stood at 351 million tonnes in FY 2022, up from 285 million tonnes in FY 2021. The domestic production with 7 per cent y-o-y growth has surpassed the pre-Covid levels.

In comparison to the same period in 2021, there was an increase in cement production of 10.9% from April to December 2022. The production of cement increased by 2,935 thousand tonnes in December 2022 alone when compared to December 2021. Cement production fell in 2020-21 as a result of the pandemic and the limitations placed on business ventures following the nationwide lockdowns.

It's interesting to note that these figures indicate that the cement industry regained the growth momentum it had before the Covid-19 outbreak. Cement production suffered during the pandemic as a result of sporadic lockdowns and mobility restrictions. The strict regulations governing economic activity, such as the suspension of building and other infrastructure development projects, remained in place until the first half of fiscal year 2022. The second wave's effects are clearly visible in India's low cement production and consumption rates. In FY 2021, the amount of cement produced fell to less than 300 million tonnes.

Government Initiatives

One of the main industries that provides the Indian Railways with substantial revenue is the cement industry. The third-highest percentage of all freight transported by railroads is made up of cement and its raw materials. In order to satisfy the needs of the cement industry, the Ministry of Railways recently announced that it intended to build dedicated corridors throughout the nation.

These corridors, which will be connected to the sources of raw materials like clinker, limestone, and fly ash, will be built particularly in regions with a higher concentration of cement factories. This will greatly lower operational and logistical costs for the cement industry. The endeavour will last for the ensuing ten years, or until the fiscal year 2033.

The government set aside US$ 1.8 billion in the Union Budget 2023-24 for a number of projects, including improving road and telecom connectivity, sanitary conditions, and safe housing. In order to address the shortage of urban housing, US$ 9.6 billion was also allocated.

India's infrastructure is expected to grow at a rate of 7% between 2022 and 2027, but 42% of the projects in the National Infrastructure Pipeline (NIP) are currently in progress.

As a direct result of the government's US$ 1.4 trillion investment in infrastructure projects between 2019 and 2023, construction activity has increased. Furthermore, it is projected that by 2030, more than 40% of India's population will live in cities, necessitating the construction of 25 million new homes. The demand for cement increased seven times, according to cement manufacturers, and production increased by two times as a result.

Expending Rs 100 lakh crores, the PM GatiShakti plan was unveiled in October 2021. The infrastructure initiatives of multiple ministries and state governments, including UDAN, inland waterways, dry/land ports, Bharat Mala and Sagar Mala, were attempted to be integrated into this plan. In order to improve connectivity and increase the competitiveness of Indian businesses, other economic zones such as textile clusters, pharmaceutical clusters, defence corridors, electronic parks, industrial corridors, fisheries clusters, and agricultural zones would be covered.

As a result, the cement industry will most likely benefit, either directly or indirectly, considering the project's high costs and wide scope. The GatiShakti programme was given central stage in the Budget 2022-23 by emphasizing the importance of excellent multimodal transport in achieving overall cost competitiveness, which will further aid in drawing in more investors.

The country's highway network was to be expanded by 25,000 km in FY 2023, which significantly improved infrastructure and raised the need for trucks and construction equipment. For the project, the government gave Rs 20,000 crores.

With the building of 400 new Vande Bharat trains and 100 cargo facilities, cement manufacturers are also benefiting from these initiatives. Critical infrastructure gaps to ports and for bulk commodities transportation, including coal, cement, fertilizers, and foodgrains, were identified in March 2023 for plan intervention.

Risks and challenges

Cement manufacturers in India may see a decline in profitability as a result of rising input costs, which include those of gypsum, coal, and pet coke. Transportation, non-physical handling duties like accounting, and the time required to complete these tasks are the costliest aspects of logistics.

Cement's weight increases the overall cost of shipping since it is transported in large quantities. There used to be some idle capacity, or about 170 million tonnes, due to cement plants' remote locations, higher freight costs, and inefficient transportation. Madhya Pradesh, Rajasthan, Andhra Pradesh, Gujarat, Chhattisgarh, Tamil Nadu, and Karnataka are home to the majority of limestone plants.

Bottlenecks in logistics and infrastructure continue to be a significant problem for the cement sector. The timely delivery of cement has been negatively impacted by inadequate road infrastructure and delays at the ports, which has further increased costs and decreased end-user satisfaction. Nonetheless, the Ministry of Railways' recent announcement that it will establish specialised corridors across the nation to satisfy the needs of the cement industry is a positive step. However, it will take time to complete the project, and it will be challenging to evaluate the immediate benefits of this effort.

Water is crucial in the production of concrete. The strength of the hardened mixture depends on the accuracy of the constituent proportions, which include cement, and water.

The regulatory obstacles include the lengthy and onerous process of obtaining approvals for the construction of new cement plants and the expansion of existing ones, which causes significant delays in the addition of capacity. The cement industry is required to adhere to emission standards, energy efficiency guidelines, and the use of alternative fuels because it plays a major role in air pollution and greenhouse gas emissions (GHGs), especially CO2. Further investments in technology upgrades are needed to meet these compliances.

A challenging year is ahead of the cement industry worldwide in 2023. Due to the geopolitical dynamics resulting from the Russia-Ukraine war and the concerning recession in the US and EU, there is a slowdown in the global demand for cement.

The path ahead

In conclusion, the cement industry's solid long-term growth fundamentals would be a major draw for foreign direct investment (FDI), as India seeks foreign investment to promote ‘Made in India’, given the necessity to develop cement production near the sources of demand. The domestic demand declined during the pandemic, resulting in a drop of approximately 300 million tonnes in FY 2021. However, the production of cement has been satisfactory in the last few years.

In addition, the Union Budget's steadfast focus on infrastructure increased demand for the sector in the ensuing years. Furthermore, the robust demand from the housing and infrastructure sectors is expected to support the cement industry in India.

In the fiscal years of 2023 and 2024, it is anticipated that cement production will increase by approximately 6-8%, primarily due to the robust demand from India's housing sector. In India, the housing sector alone accounts for 60-65% of the country's cement consumption. The government's substantial expenditures on road and highway projects will also significantly increase demand for cement.

The industry needs to put mechanisms and modalities in place to take advantage of this opportunity and integrate itself into the pattern and process of India's changing development. In order to achieve the goals of building clean, safe, and fast in accordance with the revolution of ‘rising expectations’, the industry must embrace a new vision and work together throughout the value chain.

Conclusions

The Indian cement industry exhibits robust long-term growth fundamentals, making it an attractive prospect for FDI. Despite the challenges posed by the pandemic, the industry's resilience and the government's emphasis on infrastructure development have contributed to a positive outlook.

The Union Budget's unwavering commitment to infrastructure development has been a key driver of demand in the cement sector. With a significant focus on road and highway projects, the industry is poised to experience increased demand in the upcoming fiscal years, further supported by a 6-8% anticipated growth in cement production.

The housing sector, accounting for a substantial portion of cement consumption (60-65%), is expected to play a pivotal role in driving the industry's growth. As the government allocates substantial funds to road and highway projects, the housing sector's demand for cement is set to rise, creating additional opportunities for the industry.

To capitalize on the opportunities presented by India's evolving development landscape, the cement industry must proactively establish mechanisms and modalities. Collaborative efforts throughout the value chain and the adoption of a new vision are essential for the industry to align itself with the changing patterns and processes of India's development, ensuring a successful and sustainable future.

Dr S B Hegde

Professor, Department of Civil Engineering, Jain College of Engineering and Technology, Hubli and Visiting Professor, Pennsylvania State University, USA.