RE CAPACITY ADDITION: Favourable outlook amidst execution challenges

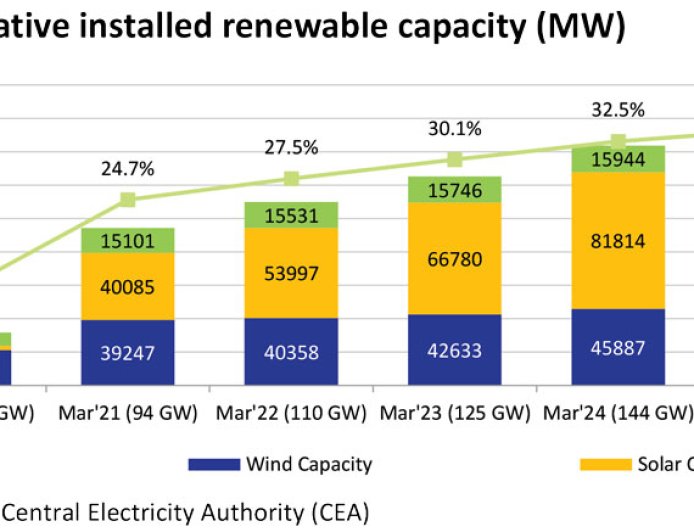

The energy transition goals set by the Government of India along with the healthy demand growth and tariff competitiveness of solar and wind power projects is leading the country towards a renewable future. The renewable energy (RE) capacity increased at a CAGR of over 16% over the past decade and this growth trend is expected to continue. The RE capacity, including large hydro, stood at 201 GW as of September 2024, accounting for 45% of overall installed power generation capacity.

The solar power segment remained the key driver of capacity addition in the RE sector, with significant capacity additions over the past 10 years, which in turn increased its share in the overall RE mix to 58.7% as of September 2024 from 8.3% as of March 2014. On the other hand, the share of the wind segment declined to 30.6% from 66.7% during this period as the capacity addition slowed down, following the shift from a feed-in tariff regime to a bidding regime.

The electricity demand growth has remained strong over the past three years with a CAGR of 8.4%, supported by the growth in economic activity along with factors like favourable base in FY2022, severe heat wave in FY2023 and an unfavorable monsoon in FY2024. The demand growth slowed down to 5.4% on a year-on-year (YoY) basis in 6M FY2025 due to rains across the country over the past two months and unfavourable base. Nonetheless, the demand growth is likely to remain comfortable at 6.0-6.5% for the full year FY2025 with higher growth expected in H2 FY2025.

The electricity demand growth has remained strong over the past three years with a CAGR of 8.4%, supported by the growth in economic activity along with factors like favourable base in FY2022, severe heat wave in FY2023 and an unfavorable monsoon in FY2024. The demand growth slowed down to 5.4% on a year-on-year (YoY) basis in 6M FY2025 due to rains across the country over the past two months and unfavourable base. Nonetheless, the demand growth is likely to remain comfortable at 6.0-6.5% for the full year FY2025 with higher growth expected in H2 FY2025.

The RE capacity, including the large hydro capacity, required to meet the renewable purchase obligation (RPO) trajectory approved by the Government of India of 43.33% by FY2030 is estimated to be over 440 GW considering the annual demand growth of 6.0% till 2030. Given the installed RE and large hydro capacity of 201 GW as of September 2024, the incremental RE capacity requirement over the next 5.5 years is large at over 240 GW, translating into an annual capacity addition of ~44 GW.

In line with the capacity targets, the Ministry of New and Renewable Energy (MNRE) issued a circular directing annual bidding trajectory of 50 GW for RE projects over the period from FY2024-FY2028. This enabled a significant pick-up in the bidding activity in FY2024 with ~47 GW RE capacity auctioned. The bids remained sizeable at 19 GW in H1 FY2025 and are expected to pick up in subsequent quarters based on the tendering pipeline.

The share of RE-based projects in all-India electricity generation is witnessing a secular growth, increasing to 13.0% in FY2024 from 7.8% in FY2018 and is likely to reach 14.5% in FY2025. This is further expected to increase to 28% by FY2030 as per ICRA’s estimates. Including the share of large hydro, the share of RE would increase to over 35% by 2030 from 21% in FY2024. This will be driven by the increase in installed RE capacity as well as improvement in the PLFs achieved by new wind and solar power projects, driven by efficiency gains.

Given the intermittent nature of RE generation, there is a requirement of energy storage capacity to ensure grid balancing. The storage capacity is expected to be used to meet the evening peak demand, when solar energy is not available, and to enable grid operators to manage the variable generation associated with solar and wind resources. The National Electricity plan (NEP) projects an installed storage capacity of 74 GW by 2032, together providing 411 GWH of storage for integrating RE with the grid through a mix of battery energy storage systems (BESS) and pumped hydro storage projects. Hence, availability of energy storage at a competitive cost remains the key to meeting these capacity targets.

Apart from the storage projects, the bidding agencies are focusing more on Firm and dispatchable supply from RE (FDRE)/round-the-clock (RTC) project tenders to mitigate the intermittency risk associated with renewables. The bid tariffs under the FDRE/RTC projects remain competitive compared to conventional sources. This has been supported by low module prices and the decline in battery energy storage systems (BESS) costs.

Coming to the RE capacity addition trends, the actual capacity addition stood at 18.5 GW in FY2024, increasing from 15.3 GW in FY2023. This is likely to increase to over 25 GW in FY2025 supported by the scale up in the project pipeline, low solar PV module prices and the impending expiry of exemption from inter-state transmission charges in June 2025. The first half of FY2025 witnessed a capacity addition of 10.9 GW, compared to 6.6-GW added in the corresponding period of the previous year. Also, the under-construction RE project pipeline remains large at 84 GW as per the status report released by the CEA as of June 2024. This comprises projects awarded by the various Central nodal agencies and projects under construction in solar / RE parks across the states under various schemes.

Despite the expected increase in FY2025, the RE capacity addition remains short of the required addition and should significantly increase to meet the RPO targets by 2030. The capacity addition is constrained by challenges in securing land, delays in augmenting transmission infrastructure and supply chain challenges for RE equipment. Resolving these challenges remains key to augmenting the RE capacity addition.

The outlook for the renewable energy sector remains Stable led by strong policy support from the Government of India, healthy demand growth, superior tariff competitiveness and sustainability initiatives by large commercial and industrial (C&I) customers. The bidding activity is expected to be led by FDRE/RTC projects, given the assured supply and competitive tariffs seen recently in relation to conventional sources. Also, the tendering activity expected to pick-up in the standalone storage segment required to support intermittent nature of RE generation.

|

Girishkumar Kadam Senior Vice President & Group Head - Corporate Ratings, ICRA |