CE industry: Riding high on India’s infrastructure story

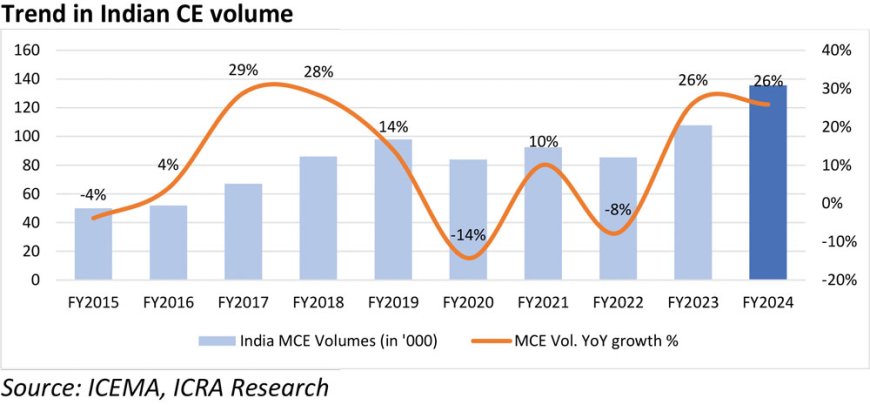

The Indian construction equipment (CE) industry reached yet another milestone in FY2024 with annual sales of 1.36 lakh units, touching an annual revenue of ~$8.5 billion (estimated). This was the second consecutive year of 26% YoY growth and sales of over one lakh units. The industry has witnessed a healthy CAGR of 12% in the last decade (FY2015-FY2024). Before the Covid-induced disruption, the Indian CE industry’s volumes had last peaked at 98,000 units in FY2019 (with CAGR of 18% between FY2015 and FY2019). However, changes in emission norms and an adverse commodity cycle disrupted the momentum in FY2020 and FY2022. Nonetheless, the strong offtake over the last two years has cemented India’s position as the third-largest CE market globally (after the US and China).

Government’s thrust on infrastructure to continue fueling growth

The CE industry derives over 90% of its sales (by volume) from the domestic market with road construction and mining & quarrying contributing 60-75% and the real estate, industrial and other urban infrastructure sectors, such as the railways, water supply and power, accounting for the rest. The industry’s strong growth in the last decade is therefore a testament to India’s infrastructure story. The capital expenditure of the public sector (including Union Government capex, grants to states for capital asset creation and investment resources of the Central PSEs) increased three-fold to Rs 18.6 lakh crore in FY2024 from Rs 5.6 lakh crore in FY2015. The improvement in the quality of spending is also reflected in the rise in the share of capex spending in the total expenditure to ~21 per cent in FY2024 from ~13 per cent in FY2019 (and will cross 23% in FY2025, as per budgetary estimates).

The GoI has launched several initiatives to encourage investment and strengthen India’s position as a viable global manufacturing hub, backed by a robust infrastructure. Significant outlay has been committed for the National Infrastructure Pipeline (NIP), road connectivity programmes (Bharatmala), port infrastructure (Sagarmala), railway upgradation, new airports/air routes (UDAN) and the Jal Jeevan Mission, among others, which are expected to keep the order books of construction players strong over the coming years. Further, a scale-up in operations/investments by the National Bank for Financing Infrastructure and Development (NBFID) and the National Investment and Infrastructure Fund (NIIF) will provide/facilitate long-term infrastructure funding. In addition, various structural reforms undertaken over the last few years, such as the recapitalisation and merger of PSBs to strengthen the financial sector, the Real Estate (Regulation and Development) Act, a uniform Goods and Service Tax, reduction in Corporate Tax etc, have improved the ease of doing business in the country. These efforts have slowly started encouraging corporates to invest in the infrastructure sector through public-private partnership models, such as the hybrid annuity model.

Infrastructure development has a multiplier effect on economy in terms of direct (job creation), indirect (efficiency gains for other industries) and induced impact (increase in economic activity leading to additional spending by consumers). Hence, there has been a massive thrust on infrastructure by the Government of India (GoI) to meet its vision of becoming a $7-trillion economy by 2030. The prospects of the MCE industry are closely linked with that of infrastructure investment, and the sector is likely to register a healthy growth over the next five years (and beyond). In fact, according to the Indian Construction Equipment Manufacturing Association (ICEMA), the CE industry could touch ~2.5-2.6 lakh units in annual sales by 2030, which would mean an estimated CAGR of 13-14% (FY2024 to FY2030).

Lagging cost competitiveness needs to be addressed

While the industry aspires to be one of the leading sectors of the Indian economy, it faces an uphill battle on several fronts. On the supply side, the industry depends on imports for critical components like undercarriage, precision hydraulics and electronics. Around ~50% of the components, by value, are being imported at present. Moreover, the availability and cost of key raw materials - speciality steel and alloys – is an issue. The high import dependence exposes the MCE OEMs to fluctuations in forex and international freight costs, besides elongating their working capital cycle because of the need to maintain higher inventory. The technology gap among tier-I vendors to produce the requisite components and the lack of a vendor ecosystem at tier 2/3 levels is another challenge. Further, India has a relative cost disadvantage in terms of key production inputs (logistics, power, and financing costs) vis-à-vis China, Japan, South Korea, etc. which more than offsets the benefits of savings in labour cost.

On the demand side, a lack of sustained domestic demand due to economic cycles or delays/ambiguity in the implementation timelines of infrastructure projects constrains the industry’s ability to assess and invest timely in R&D and capacity creation. While MCE exports offer tremendous potential (as India’s share in global MCE trade is less than 2% at present), low-cost competitiveness and the absence of any emission regulations for off-highway equipment (given the increasing global focus on sustainable technologies) remain the bottlenecks.

Given the changing geo-political dynamics, global OEMs are on the lookout to diversify their supply chains outside China, which presents an opportunity for increasing domestic manufacturing and developing a robust CE component ecosystem. Also, the sluggish developed markets have made global investors keen to invest in India, which is slated to be among the fastest growing economies in the coming decade. In this backdrop, consistent and collaborative efforts by the Government, industry and financial intermediaries will be crucial for alleviating these persisting challenges.

Medium to long term outlook remains promising

The Government’s pre-election push on project execution had created a strong demand momentum for the CE industry in the last two years. However, the volumes are likely to dip in FY2025, driven by a disruption in project award activity between January and May 2024 due to the Union Elections (also seen in the previous election cycles) along with the expected slowdown in construction activities in Q2 FY2025 because of the monsoons. A possible disruption in demand due to transition to CEV-V emission norms (and related price hikes) from January 2025 also remains a monitorable over the next 12-15 months. Nevertheless, the industry’s long-term prospects remain positive.

According to the ICEMA, the Indian CE industry has the potential to become the second largest globally, with $25 billion in revenues by 2030. To reach its goal of transforming India into a ‘developed country’ by 2047, the Government would have to develop infrastructure faster than before. This would mean increasing the number and/or ticket size of the projects and introducing higher mechanisation levels and technologically advanced equipment to ensure timely implementation. The domestic CE industry already has a strong product line and with the debottlenecking of key issues, it has the potential to emerge as a strong global player in the coming decade.

Ritu Goswami

Assistant Vice President and Sector Head, Corporate Ratings, ICRA Limited