Construction sector POISED for another GROWTH CYCLE

Sustained capital outlay towards infrastructure augurs well for the construction sector; entities’ revenue likely to rise by 12-15% in FY2025.

The Indian infrastructure sector is poised to sustain its healthy growth momentum over the medium term, supported by healthy capex outlay across various infrastructure sub-segments. An uptick in the capex has also led to a rise in the bank credit to the construction sector, which rose by 7.8% on a YoY basis to Rs 1.32 lakh crore as of October 2023. Supported by government inititiatives, ICRA expects the operating income of construction entities to grow by 12-15% in FY2025. While the construction entities’ order book to billing (OB/OI, based on FY2023 numbers) remained stable at around 3.2 times as of September 2023, with the General Elections expected in April/May 2024, the new order inflows are likely to moderate. This is expected to result in a reduced, but healthy OB/OI ratio of 2.8-3.0 times by March 2024. The operating profitability would be in the range of 11.5-12.5% by FY2025 and the credit profile of construction companies, which have diversified presence across multiple infrastructure-sub segments, is expected to remain stable.

Infrastructure segments to drive the construction sector growth

The construction sector gross value added (GVA) is expected to grow by 8.5-9% in FY2024 and by 7-7.5% in FY2025, as per ICRA’s estimates. This comes on the back of a robust YoY growth of 7.9% and 13.3% in Q1 FY2024 and Q2 FY2024, respectively, mainly driven by healthy pace of execution and moderation in raw material prices. Despite moderation in the growth rate from FY2023 level (+10% YoY), it remains higher than the long-term annualised growth rate of 5.3% during FY2012-FY2023, indicating favourable growth prospects for industry participants.

Road sector

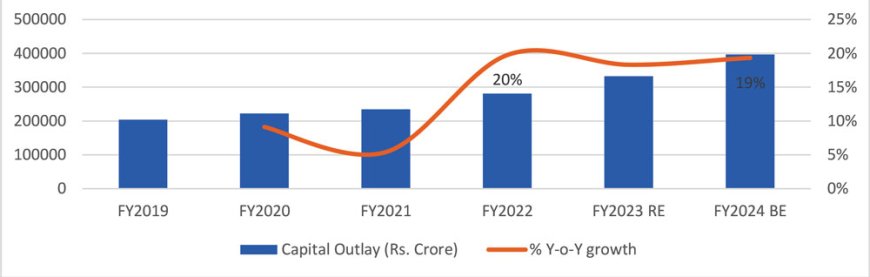

The aggregate annual capital outlay by the Ministry of Roads Transport and Highways (MoRTH) and capital outlay by 13 key Indian states rose at a healthy CAGR of 14.2% over FY2019-FY2024 budget estimates (BE) period, including a robust growth of 18-20% per annum in the capital outlay in the last three years. The overall impact of the increase in capital outlay by the state governments and the GoI, coupled with the numerous schemes/plans in the sector (like Bharatmala Pariyojana, Pradhan Mantri Gram Sadak Yojana) would enable the companies to maintain a healthy order book.

Railway sector

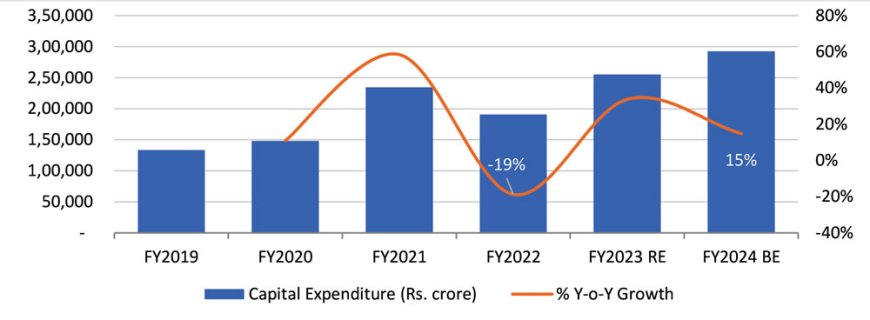

Indian Railways has been undertaking sizeable capital expenditure over the years towards maintenance, upgradation and modernisation of the railway infrastructure, as well as adopting new technology and high-speed trains. The capex towards railways (both budgetary support and funding through internal and external budgetary resources) has increased at a CAGR of 17% over FY2019-FY2024 (BE) period to Rs. 2.92 lakh crore (including a YoY increase of 15% in FY2024 (BE)).

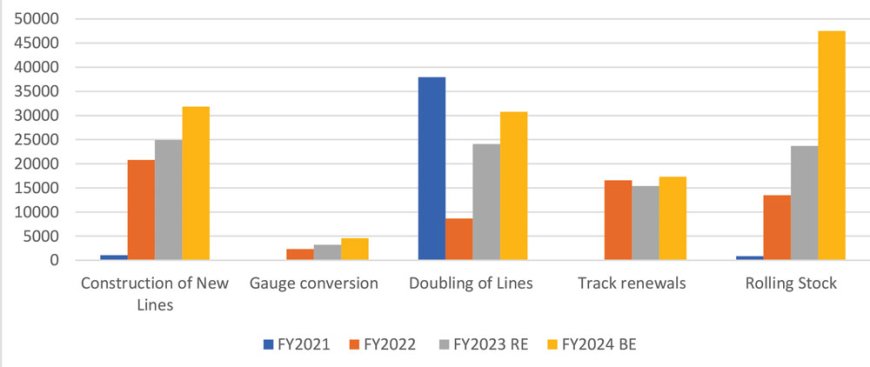

The Indian Railways has made significant progress in terms of electrification of its network, with around 19,300 km of projects completed in the last three years. The construction of new lines increased at a CAGR of 28% to 600 km over FY2021-FY2024 (BE) and doubling of lines rose at a CAGR of 20% to 2,800 km during the same period. In absolute terms, over FY2021-FY2024 (BE) period, the capital outlay towards construction of new lines has increased at a CAGR of 211% to Rs 31,850 crore. For gauge conversion, the capital outlay has increased at a CAGR of 240% to Rs 4,600 crore during the said period and for rolling stock, the same rose at a CAGR of 284% to Rs 47,510 crore.

Water supply and sanitation

EPC entities have witnessed strong order inflow in water and sanitation segment in the backdrop of the Central Government’s ambitious schemes like Har Ghar Jal under Jal Jeevan Mission (JJM)and the sewage treatment under National Mission for Clean Ganga scheme. The players present in the water and sanitation segment are likely to witness healthy revenue growth in the medium term. The capital outlay (by 13 key Indian states mentioned earlier) towards water supply and sanitation rose at a healthy CAGR of 22% during FY2019-FY2023 and is estimated to remain healthy with focus on water supply projects under the JJM, as evident from the budgeted increase in the capital outlay by 12% for FY2024 (BE) over FY2023 (RE).

Competitive intensity continues to remain high

Among the key infrastructure segments, roads (EPC) sector continues to witness the highest competitive intensity with 10-15 bidders per contract on an average, along with instances of bidding at 43% below the base price. ICRA’s analysis indicates that compared to roads (EPC), the competitive intensity, is relatively lower in water and sanitation with 4-10 bidders per contract in each of these segments on an average. The competition in other sub-segments like metro, irrigation and railways also remains relatively lower than NHAI-HAM or NHAI-EPC projects. Notwithstanding the intense competition, the operating leverage benefits and expectations of stable raw material price are likely to support the profitability of construction companies.

Chintan D. Lakhani

Vice President - Corporate Ratings, ICRA Limited