Favourable outlook on demand GROWTH and FOCUS on RENEWABLES

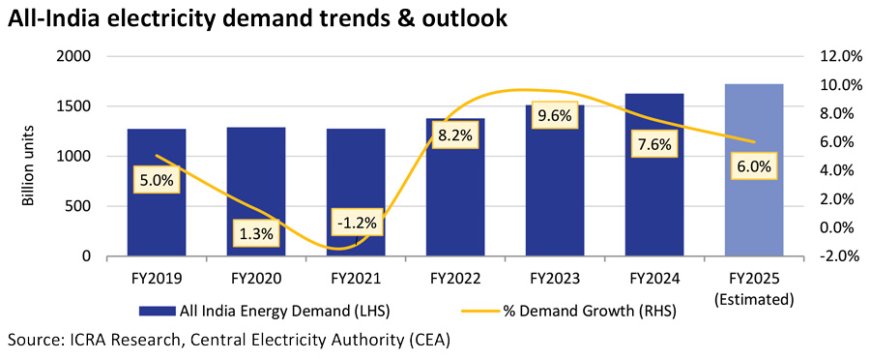

The electricity demand growth has remained strong over the past three years with a CAGR of 8.4%, supported by the growth in economic activity along with factors like favourable base in FY2022, severe heat wave in FY2023 and an unfavorable monsoon in FY2024.

The electricity demand growth has remained strong over the past three years with a CAGR of 8.4%, supported by the growth in economic activity along with factors like favourable base in FY2022, severe heat wave in FY2023 and an unfavorable monsoon in FY2024. The demand growth remained healthy at 9.9% on a year-on-year (YoY) basis in the first four months of FY2025. While the demand growth slowed in the last few months, it is likely to remain comfortable at 6.0-6.5% for the full year FY2025.

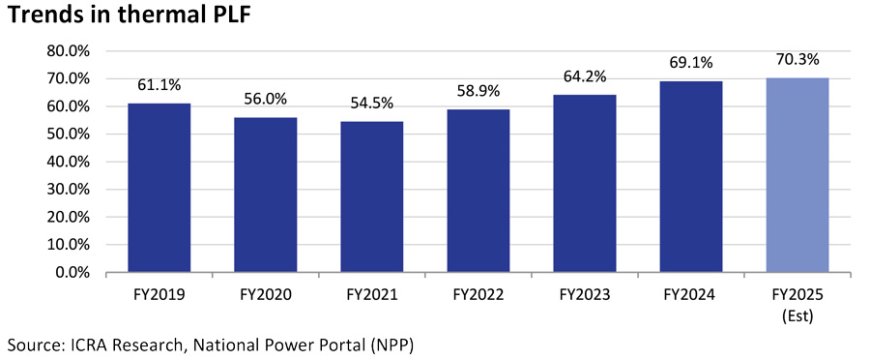

The growth in electricity demand enabled an improvement in the all-India plant load factor (PLF) for thermal power stations to 69.1% in FY2024 from the low of 54.5% in FY2021. The PLF is expected to cross 70% in FY2025. The growth in electricity demand improved the visibility on new power purchase agreements (PPAs) for thermal power generators. Also, the tariffs in the short-term market witnessed a significant improvement over the past three years driven by the demand growth. All these factors improved the outlook for thermal power generators.

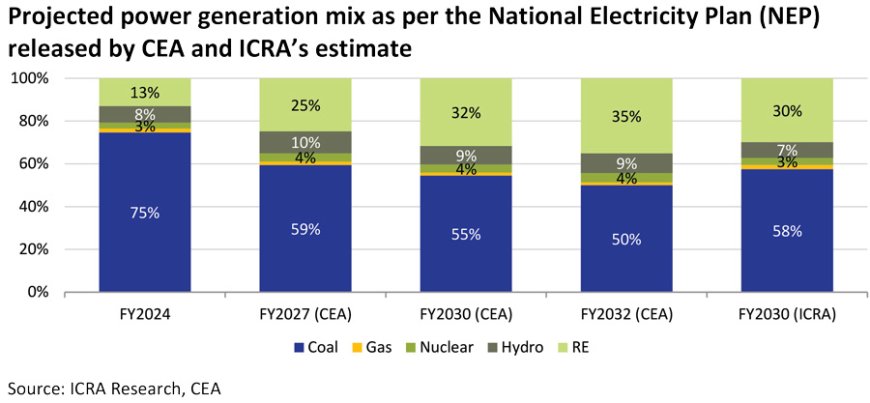

In line with the commitments made by the Government of India at the COP26 summit, the focus remains on promoting the addition of renewable power capacity, including large hydro projects in the country. The Ministry of Power (MoP) has notified the trajectory for the renewable purchase obligation (RPO) from FY2023 to FY2030, which is set to increase from 24.61% in FY2023 to 43.33% by FY2030, comprising wind, hydro and other renewable sources.

The renewable capacity, including the large hydro capacity, required to meet the notified RPO trajectory is estimated to be 420 GW by FY2030 considering the annual demand growth of 5.0% till 2030. The capacity requirement will be higher if the demand growth were to be higher than 5.0%. Given the installed renewable and large hydro capacity of 191 GW as of March 2024, the incremental RE capacity requirement over the next six years is large at ~230 GW, translating into an annual capacity addition of close to 40 GW.

However, the actual annual capacity addition was relatively lower at 18.5 GW in FY2024. While this is likely to increase to 25 GW in FY2025, it would remain lower than the required addition. Despite the large project pipeline, the capacity addition is constrained by challenges in securing land, delays in augmenting transmission infrastructure and supply chain challenges for solar and wind equipment. Resolving these challenges remains key to augment the renewable capacity addition and meet the climate change goals as well as meet the growing demand.

The growth in renewable power capacity is estimated to increase the share of renewable generation (including large hydro) in the all-India electricity generation to ~40% by FY2030 from 21% in FY2024. On the other hand, the share of coal-based generation would come down to ~60%in FY2030 from 75% in FY2024.

Given the intermittent nature of wind and solar power generation, achieving such high level of renewable share in the generation mix requires the use of storage capacities i.e., battery energy storage systems (BESS) and pumped storage hydro projects (PSPs). While one way to handle the intermittency is through adequate storage capacities at a grid level managed by the load dispatch centers/discoms, the other way is to manage the supply at the generator level through a combination of hybrid RE projects complemented with storage systems to provide round-the-clock (RTC) and firm and dispatchable RE (FDRE) supply to the grid. Both ways are being explored in the Indian market.

Apart from the focus on renewables, the sharp growth in electricity demand is necessitating a rethink by on thermal capacity addition, with the government looking to encourage investments in new thermal power projects, including by the private sector, with the target of adding 80 GW of new thermal power capacity by 2032 to meet the growing energy requirement.

Coming to the distribution segment, the performance of state-owned distribution utilities (discoms) remains constrained by inadequate tariffs relative to the cost of supply, higher-than-regulator-approved aggregate technical and commercial (AT&C) losses and a considerable debt burden. Except for discoms in Gujarat, most state-owned discoms remain loss-making despite the recent reduction in AT&C losses. The all-India AT&C losses for state-owned discoms declined from 23.0% in FY2021 to 16.5% in FY2022 and further to 15.8% in FY2023 led by infrastructure upgrades and improved subsidy pay-out. Despite this progress, losses remain particularly high at over 20% for the discoms in Bihar, Jharkhand, Madhya Pradesh, and Uttar Pradesh.

Reforms are under way to address the challenges faced by the distribution segment, including the Revamped Distribution Sector Scheme (RDSS) to reduce AT&C losses, the late payment surcharge (LPS) rules to ensure timely payments from discoms to generators and the Fuel and Power Procurement Adjustment Surcharge (FPPAS) to ensure the regular pass-through of variations in power purchase cost. The LPS scheme has enabled a significant decline in dues pending from discoms to power generating companies.

However, there is a mixed progress in implementation of FPPAS rules notified by the Ministry of Power, Government of India in December 2022. The gap between the average cost of supply (ACS) and the average revenue realisation (ARR) per unit of power sold by the state-owned discoms was high at 73 paise per unit in FY2023. The hike required to reduce this gap to zero is close to 10% and varies across the states. This apart, the discoms would need to resolve the large regulatory asset position, which necessitates support from the state governments. Overall, the discom finances can be improved through a mix of measures such as graded tariff hikes, reduction in AT&C losses and optimisation of power purchase cost.

|

Vikram V Vice President & Co-Group Head - Corporate Ratings, ICRA Limited |