INDIA AIMS massive highway expansion

The Government of India has set a target of increasing the length of the national highways to ~200,000 km by 2037 from 146,145 km in 2024, while simultaneously increasing the length of the access-controlled highways by more than 12 times to 50,000 km from the current 4,000 km. Going forward, a majority of the greenfield highways are planned as 4-lane or 6-lane or 8-lane roads with the land acquisition being done currently for future lane expansions.

The Government of India has set a target of increasing the length of the national highways to ~200,000 km by 2037 from 146,145 km in 2024, while simultaneously increasing the length of the access-controlled highways by more than 12 times to 50,000 km from the current 4,000 km. Going forward, a majority of the greenfield highways are planned as 4-lane or 6-lane or 8-lane roads with the land acquisition being done currently for future lane expansions. Further, the Ministry has supported road execution through various initiatives, including project awards through introduction of the Hybrid Annuity Model (HAM) or higher share of engineering, procurement, construction (EPC) projects, higher budgetary allocation, resolution of Right of Way (RoW) issues, and approvals for faster on-ground execution among others.

The capital spending of the Ministry of Road Transport and Highways (MoRTH) increased by more than eight times to Rs 2.72 lakh crore in FY2025 BE from Rs 0.31 lakh crore in FY2014 at a CAGR of 22%, signifying the Central Government’s focus on road development. From FY2015 to FY2024, the Ministry has constructed more than 96,000 km roads, a combination of both greenfield and brownfield expansions.

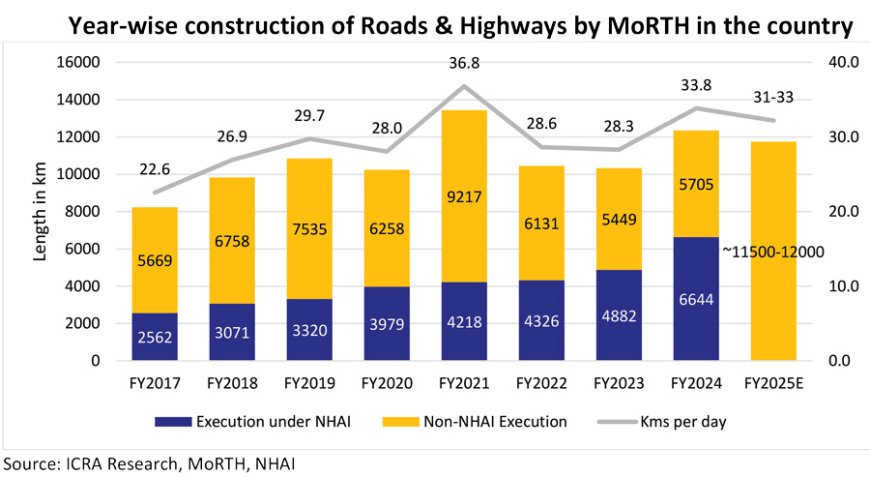

The pace of execution improved by ~20% in FY2024 to 12,349 km from 10,331 km in FY2023 owing to the Government’s focus on execution and higher allocation to the road ministry. However, the execution declined by 14% to 1,934 km in Q1 FY2025 from 2,250 km in Q1 FY2024 on account of the slowdown in construction activity due to the General Elections. Despite the lower execution in Q1 FY2025, ICRA expects road execution to marginally decline to 11,500-12,000 km (~31-33 km/day) in FY2025 due to strong budget outlay and governments focused on execution. Nonetheless, given the increasing share of 4/6/8 lane projects, the lane-km growth on YoY basis will remain healthy.

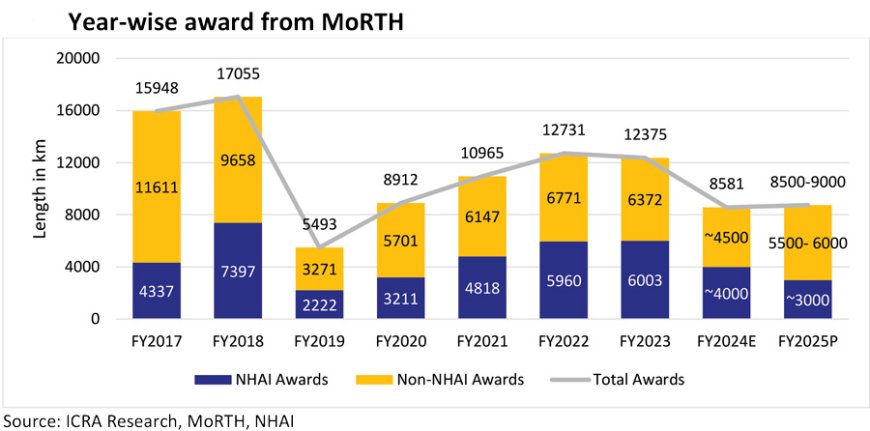

The awarding had improved over the years from a low of 5,493 km in FY2019 to 12,731 km in FY2022 and 12,375 km in FY2023 owing to the positive impact of the various initiatives by the GoI, including the awarding under Bharatmala Pariyojana (BMP). However, the awarding had been significantly impacted in FY2024 amid the delay in approval from the Cabinet for revised cost estimates of BMP. Consequently, the overall awards declined by 31% to 8,551 km in FY2024 from 12,375 km in FY2023. The awarding activity remained muted in Q1 FY2025, on account of the Model Code of Conduct, which ended on June 6, 2024, coupled with restrictions on project awards due to pending Cabinet approval for BMP cost revision. With receipt of approval from the ministry on project awards in August 2024, ICRA expects the awarding to pick up from H2 onwards and is expected to remain at 8,500-9,000 km in FY2025, similar to 8,581 km in FY2024.

Key challenges in roads & highways sector

Land acquisition: Delay in land acquisition was one of the major factors adversely affecting the timely implementation of highway projects in the country. Further, the cost of land acquisition had increased significantly, post the amendments to the Land Acquisition Act in 2013. As per the Ministry, the average cost of land acquisition was about Rs 80 lakh/hectare before 01.01.2015, however, it went up to about Rs 3.60 crore/hectare as of December 2018 and has further gone up in the recent years. Over the past 5 years (around FY2019-FY2024), the National Highways Authority of India (NHAI) has spent Rs 1.67 lakh crore on land acquisition compared to Rs 0.81 lakh crore during FY2015-FY2018.

Intense competition: The competition in the roads and highways sector has increased in the last three years with expansion of qualification criterion, state-government focused contractors bidding for the NHAI projects, which is reflected in several projects being awarded at a significant discount to the authority’s base price. Given this, the contractors’ ability to execute these projects within the budget and in a timely manner remains critical. Further, their ability to bring in requisite equity and tie up the debt for the development projects under HAM remains crucial for timely implementation of these projects.

Alternate routes and modes of transport for toll projects: Alternate routes and transport modes pose a significant threat in terms of shift of traffic from the existing routes to new ones. The development of greenfield highways and expressways with focus on the shortest path between the origin and destination is transforming the road network in the country and is likely to compete with the old road network. Further, an alternate mode of transport, including a dedicated freight corridor (DFC) and a regional rapid transport system (RRTS) are expected to pose threats to the existing road network in the country in the medium term.

The way forward

Of the total MoRTH awards over the last three years, the EPC remained the preferred route and constituted more than 70%, whereas HAM accounted for around 25-30%. The share of HAM projects in the overall awarding mix dipped in FY2024 to around 20%, due to pending Cabinet approval for the revised cost of BMP. While the EPC is likely to remain the preferred route for the road awards for the MoRTH, the share of BOT projects is expected to improve to around 45-50% in the medium term, given that projects above Rs 500 crore are expected to be awarded in the BOT mode (including both HAM and Toll).

Further, the Ministry is gradually shifting its focus on to BOT (Toll) projects, and the NHAI is targeting to award ~Rs 44,400-crore BOT-Toll project awards covering about 937 km in FY2025. The recent changes in the model concession agreement in capacity augmentation for BOT-Toll projects is a right step in addressing some of the concerns of concessionaires and lenders. ICRA expects the BOT-Toll awards share to increase to around 5% in FY2025 compared to less than 2% of the awards in the last five years. In the near term, a ramp-up in awarding activity remains crucial for road construction to maintain a healthy execution pace in the medium term.

The NHAI has raised a total of Rs 42,334 crore through monetisation of an aggregate length of 2,285 km via the TOT model. Under the InvIT mode, it has also realised Rs 25,824 crore through monetisation of 1,525 km. In April 2024, the NHAI had released an indicative list of 33 road assets it plans to monetise in FY2025 through the TOT/InvIT mix. ICRA estimates a monetisation potential of Rs 53,000-60,000 crore from the sale of these road assets. While most of these assets are expected to be monetised in the current fiscal, some of them are likely to spill over to the next fiscal.

ICRA expects the awarding to pick up from H2 onwards and is expected to remain at 8,500-9,000 km in FY2025, similar to 8,581 km in FY2024, while road execution to marginally decline to 11,500-12,000 km (~31-33km/day) in FY2025 due to strong budget outlay and governments focused on execution.

|

Vinay Kumar G Vice President & Sector Head - Corporate Ratings, ICRA Limited |