Indian ports witness HEALTHY VOLUME GROWTH

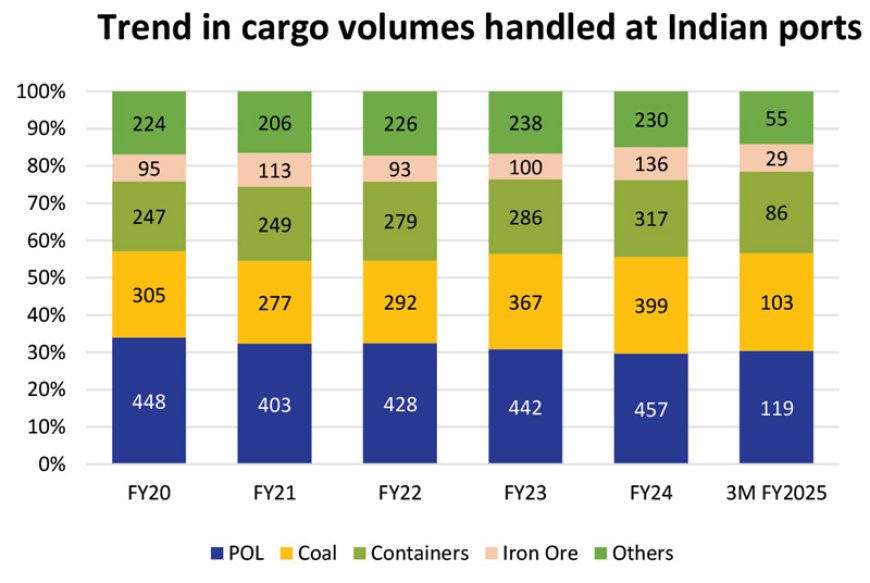

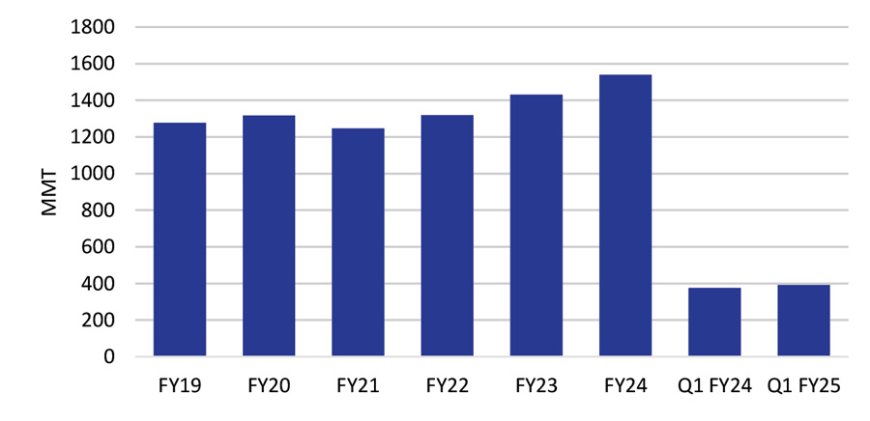

India’s long coastline of ~7517 km lies close to several international shipping routes and boasts of 12 Major Ports (administered by the Government of India). Additionally, there are around 200 Non-Major ports (administered by the state governments) out of which currently 65 are functional. Ports are a key part of the infrastructure, enabling economic growth and trade in the country with nearly 90% of the EXIM trade volumes flowing through them. Indian ports have been witnessing a healthy growth in cargo volumes over the last several years with volumes rising to 1.5x over the course of FY2015 to FY2024. In terms of cargo profile, petroleum products (including crude oil, LNG, LPG etc) continue to contribute around 30% of the total cargo, followed by coal (26%) and containers (21%).

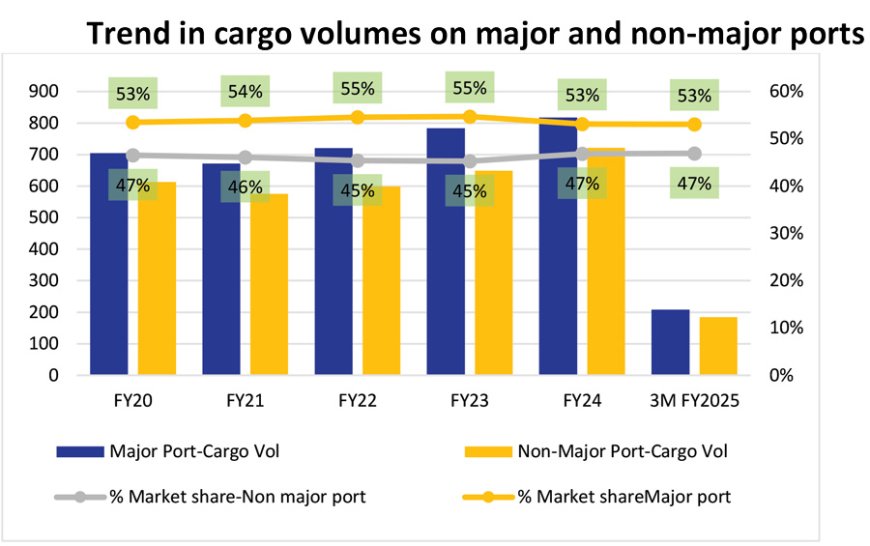

Over the past decade, the cargo profile has undergone a change with the share of POL products moderating from ~35% to around 30% and that of containerised cargo rising from 16% to 21%. The increase in the containerised cargo flow has been supported by increasing exports of cargo needing containerised transportation along with improving hinterland connectivity and container-handling infrastructure at ports. While the major ports continue to handle a larger share of the cargo currently, the non-major ports’ market share has increased by ~400 bps over the course of FY2015 to FY2024. This has been possible through better services offered and the independence to set tariffs, which allowed the ports to gain traffic from major ports.

Over the past few years, ports have invested in efficiency-improvement initiatives and the investments are expected to continue under the Sagarmala programme, going forward. Under this initiative nearly Rs 32,066 crore has already been invested in port modernisation projects till March 2024 whereas another Rs 75,650-crore worth of projects are under various stages of implementation, focusing on capacity enhancement at major ports as well as efficiency improvement. Additionally, the GoI has also invested in improving port connectivity to the hinterlands through improved rail and road connectivity, thus resulting in faster evacuation of cargo from ports.

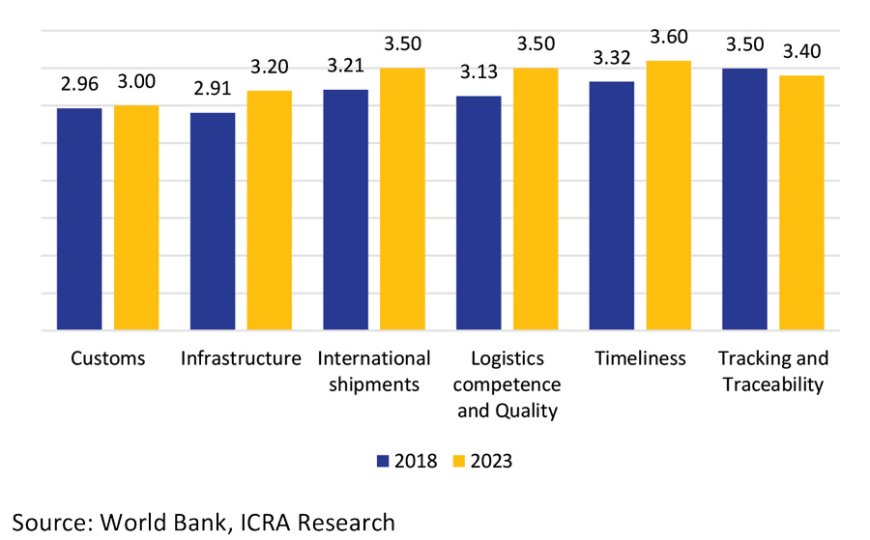

As per the Logistics Performance Index (LPI) report published by the World Bank, India’s LPI rank improved to 38 in CY2023 vis-à-vis 44 in CY2018. The country witnessed an improvement across most of the parameters evaluated under the study over the course of 2018 to 2023. The most notable area of improvement being infrastructure and logistics competence and quality, with improvement in the timelines as well the ability to offer competitively-priced international shipments. Over the past few years, significant investments have been undertaken in improving port infrastructure by the GoI as well as the private sector. The logistics sector has also witnessed heightened investment activity following expansion of warehousing capacity, and notable rail as well as road logistics infrastructure development.

The large investments being undertaken in development of deep draft seaports at Vizhinjam and Vadhawan ports along with significant capacity additions at other ports, will further enable the Indian ports to accommodate ever-increasing vessel sizes going forward. Additionally, with increasing digitisation measures underway across the logistics value chain in the country along with the mechanisation of port operations, Indian ports are becoming more efficient and catching up with their global counterparts. Going forward, with continued investment in upgradation of the infrastructure, Indian ports should be able to further close the gap with the global ports in terms of operating parameters and thus attract more traffic. Additionally, with Indian economy expected to grow at a healthy pace going forward, it will be imperative for them to improve their performance to bring down a part of the overall logistics cost and aid the competitiveness of the economy.

While Indian ports have witnessed significant improvement in performance, there are several issues that continue to hamper the progress on further improvement in the port performance and cargo flows. Currently, most ports in India have inadequate draft to handle large-sized vessels and as a result, several vessels are unable to dock in some ports, resulting in additional logistics cost, as the cargo from Indian ports have to first travel to a trans-shipment terminal e.g. Colombo Port, following which the cargo is loaded on to the mother ships. This results in additional cost and time for shipping, thus limiting the competitiveness of India exporters.

The Indian port sector also faces delays in dispute resolution amongst the various stakeholders and the port terminal operators. While several processes have been put in place, several arbitrations and issues continue to await resolution despite significant time being invested for the dispute. Additionally, the under-developed cargo handling infrastructure in the hinterland and port connectivity continue to hamper the overall logistics cost and thus also limits the cargo flows. Over the last few years, there has been significant improvement in terms of railway connectivity of the hinterland to the ports through the Dedicated Freight Corridors (DFCs), which will improve the cargo flows into and out of the port. However, the same needs further development through high-speed road corridors etc. for ease of evacuation. On the regulatory front, the GoI had passed the Major Port Authorities Act-2021 (MPAA-2021) in November 2021, providing freedom for setting tariffs for the new terminals at major ports, in line with the non-major ports. However, the transition of the terminals on the Major Ports contracted prior to November 2021, to a market-based tariff setting mechanism remains work in process and remains a key concern for these terminal as it does not allow a level playing field in terms of tariff setting.

The Indian port sector continued to witness stable performance with overall cargo volumes growing by ~7.5% YoY in FY2024. The volume growth was underpinned by a robust container volume growth of ~11% YoY followed by the growth of 8.7% YoY in the coal cargo volumes handled at the ports. The other segments like iron ore witnessed a 36% YoY surge followed by the petroleum products (POL), which saw a 3.5% YoY growth. The container volumes grew owing to rising containerisation of cargo in the country. The coal volumes growth was driven by the GoI directive for blending imported coal to meet the rising demand for power, particularly in the summer and monsoon seasons. The iron ore volumes handled at the ports surged owing to strong demand from China and also the base effect of FY2023, wherein export duty levied on export of iron ore had led to lower exports.

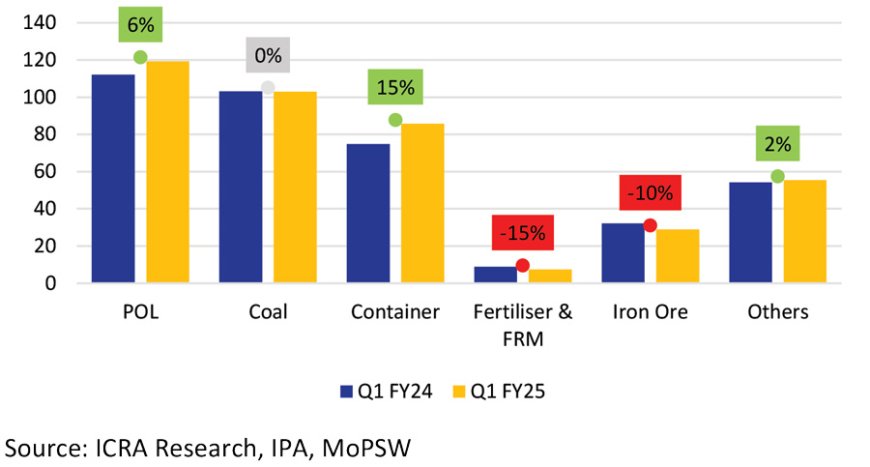

In the current financial year so far i.e. Q1 FY2025, overall cargo volumes witnessed a tepid growth of 4% YoY. The growth has been largely backed by a 15% YoY development in the container cargo volumes and a 6% YoY advance in the POL volumes handled at the ports. The growth in these two segments was partially offset by lower fertiliser (-15% YoY) and iron ore volumes (-10% YoY) while the coal volumes were largely unchanged YoY. ICRA expects the port volumes to witness a growth of around 6-8% YoY in FY2025, driven largely by the container segment and modest growth in the coal and petroleum products volumes. The iron ore volumes are expected to moderate in the current fiscal, post a sharp rise in the exports in FY2024 amid weak demand for steel in China.

|

Varun Gogia Assistant Vice President & Sector Head - Corporate Ratings, ICRA Limited |