The real estate industry has staged a slow but steady resurgence.

- Rohan Khatau Director, CCI Projects How do you assess Western Region as the key real estate market in India? The Indian real estate market has grown significantly year on year. Taking a closer look at the western belt of India, states like Maharashtra, Gujarat, and Goa have evolved into some major investment hotspots. This

- Rohan Khatau

Director, CCI Projects

How do you assess Western Region as the key real estate market in India?

The Indian real estate market has grown significantly year on year. Taking a closer look at the western belt of India, states like Maharashtra, Gujarat, and Goa have evolved into some major investment hotspots. This has been possible due to the development of new projects across segments. Various offerings in the affordable luxury space, with record low-interest rates and prices, and a huge infrastructure boost in the western region are driving the Indian real estate market.

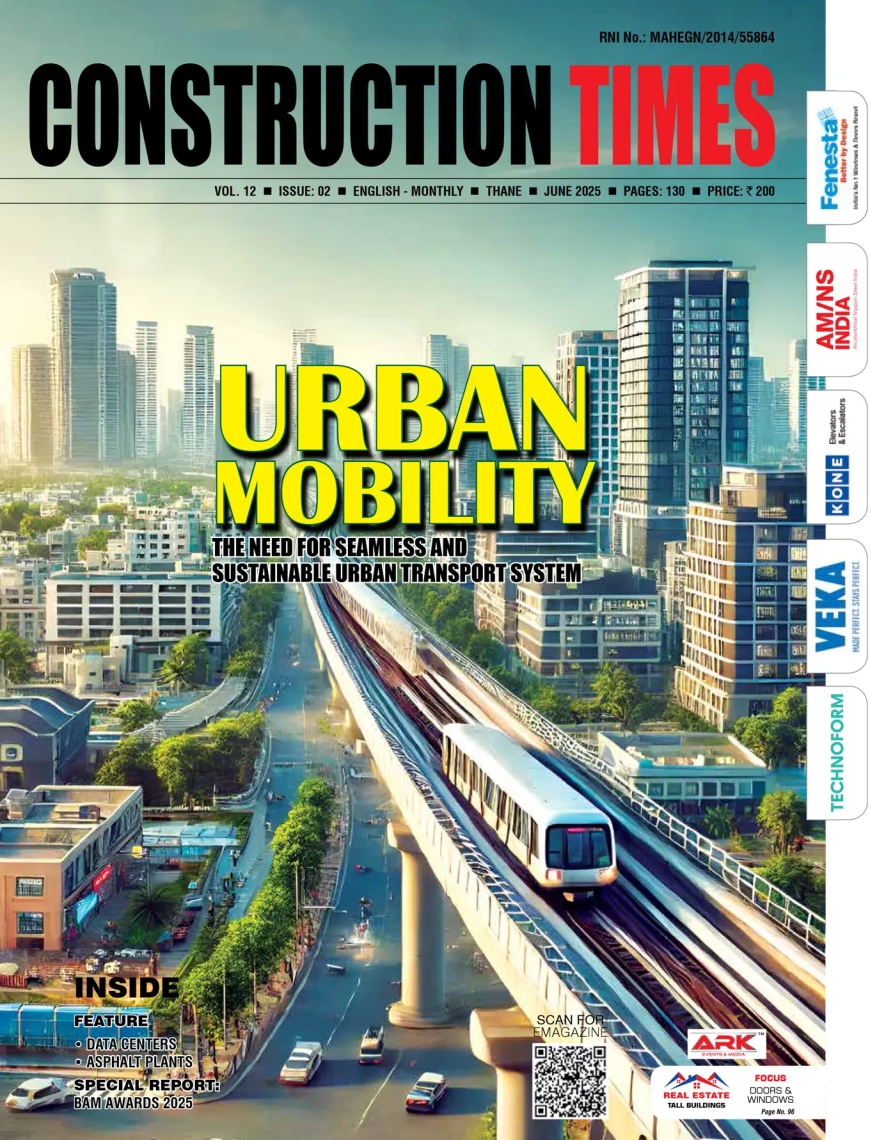

The rapid advancement of the Mumbai Metropolitan Region has resulted in the rise of prime residential hotspots within the city. Mumbai's western suburb is one such area that has undergone a transformation in terms of infrastructure development over the years and emerged as a lucrative investment option opportunity. Amplified social infrastructure, connectivity, and a surge in demand for residential projects in the western belt have incited more queries from homebuyers. The expansion of the Metro line has proved to be an additional boon to developers thus investing in land parcels around Metro vicinities with optimum convenience makes for a compelling proposition. Furthermore, the Metro 2A, Metro 7, and Metro 3 routes will push these areas forward in terms of real estate development. It has been stated that property sale registrations in Mumbai surged by 70% in 2021 from the pre-pandemic year of 2019.

What are the latest market trends in the region, especially in the markets of Mumbai, Pune, and Ahmedabad?

The pandemic had such a drastic impact on the Indian real estate market that it brought purchases to a standstill. The real estate industry has staged a slow but steady resurgence. After the first lockdown in April 2020, consumers especially from Mumbai, Pune, and Ahmedabad markets realised the value of homeownership. The demand for larger homes, aspirational amenities, low home loan interest rates, low stamp duty, attractive property rates, and rising household savings were some trends that helped pick up momentum for the sector. The demand for primary micro-markets providing the best connectivity and basic infrastructure plays a vital role for developers and homebuyers alike.

How is development in tier-2, tier-3 cities changing the prospects of the real estate in the region?

There's been a constant gain in traction in the tier-2 and tier-3 cities. The aspirational mind-set of the consumer has led them to choose a lifestyle that comes with state-of-the-art amenities, flexi-work models, and sustainable spaces. Individuals who are working from home are now investing in tier-2 and tier-3 cities where their urban ideas can be adapted. Developers are also looking to attract customers with special layouts and the demands coming in from consumers. Tier 2 and 3 cities are becoming a hotspot for attracting investment and stimulating economic growth in India's real estate sector because of developing special economic zones, satellite offices, industrial corridors, and commercial clusters. Tier 2 and tier 3 cities are storming towards modern growth, owing to the government's supportive policies like PMAY for affordable housing, as well as NRIs feeding the cities with investments.

Hits: 0