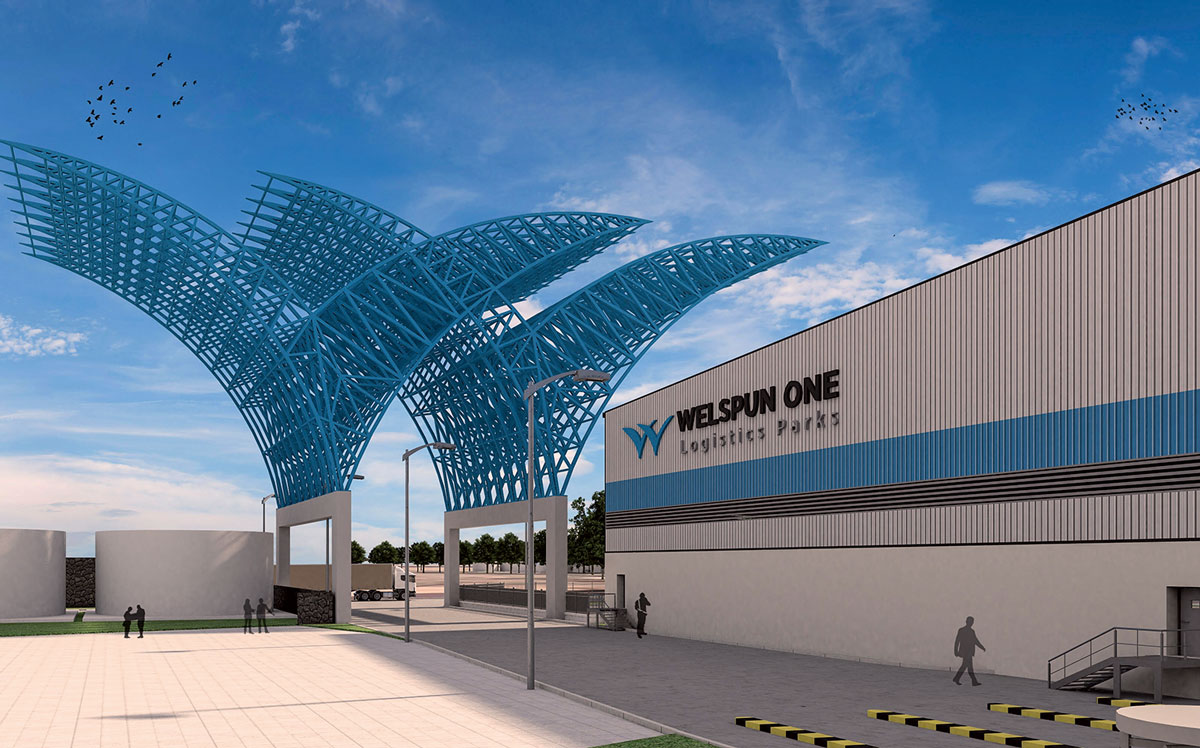

We plan to develop & lease a portfolio of 7-8 mn sq ft of Grade-A warehousing spaces across India

Anshul Singhal: The last financial year proved to be positive for the warehousing sector. With rising investor interest and timely policy interventions by the government, the sector witnessed investments exceeding $1.5 billion in 2021, making it the highest after the office sector, to attract such investments. The warehousing market is a large scale employer, both during the construction and operations phases.

Anshul Singhal

Managing Director, Welspun One Logistics Parks

How is the logistics and warehousing sector progressing in the country as we move forward to US$5 trillion economy?

The last financial year proved to be positive for the warehousing sector. With rising investor interest and timely policy interventions by the government, the sector witnessed investments exceeding $1.5 billion in 2021, making it the highest after the office sector, to attract such investments. The warehousing market is a large scale employer, both during the construction and operations phases. Given that warehousing projects are generally built in semi-urban locations, they significantly contribute to the economic development of surrounding communities as well. The sector has been drawing strong operator and investor interest due to increased demand from ecommerce and 3PL post-pandemic. In 2021, 62 per cent of the total warehouse absorption was driven by third-party logistics (3PL) players and e-commerce companies followed by the manufacturing sector at 14 per cent.

The Indian logistics sector is one of the biggest in the world, growing at an average of 10.5 per cent every year and valued at around $215 billion.

In India, logistics cost 14 per cent of the GDP compared to the global average of 8 per cent. Do you foresee the recent policy changes and reviving transportation infrastructure to bring down the logistics cost?

Yes. Absolutely the measures taken by the governing bodies will bring down the costs. The policy changes have been designed to lower the logistics cost down to 9-10 per cent from the current 13-14 per cent which is much higher than in other developed countries.

Apart from systematic reforms like implementation of the GST and accordance of infrastructure status to the sector, it is going through many positive changes. On the policy front, there have been multiple reforms introduced including planned infrastructure projects alongside multimodal logistics parks which would help achieve a drop in logistics costs.

The game-changer has been the ambitious PM GatiShakti National Master Plan, which includes a strategic focus on the seven engines for economic transformation, seamless multimodal connectivity and logistics efficiency.

How is the warehousing and logistics market picking up in the post-Covid scenario?

Like any other sector, the warehousing and logistics sector also was impacted in the initial days of the nationwide lockdowns. But the lockdown propelled a large number of consumers to turn to the Internet for anything and everything. This brought about a change in consumption patterns driving the e-commerce industry to witness a huge increase in demand. This sudden spike in online shopping further pushed the demand for the warehousing and logistics sector. At a time when retail and office space was impacted, the warehousing sector emerged as a resilient sector.

Despite the pandemic, leasing of industrial and warehousing spaces across eight major cities saw a 35% rise during 2021 (35 million sq ft). Delhi-NCR saw the highest absorption in 2021 at 8.1 million sq ft, followed by Pune at 6.5 million sq ft. Leasing of industrial and warehousing space stood at 8.6 million sq ft in 11 tier II, and III cities while new supply was at 8.9 million sq ft. Absorption of grade A spaces increased from 56% in 2020 to 73% in 2021.

What are the latest technology trends in logistics and warehousing?

The rise of e-commerce has led to the demand for more responsive supply chains and the need to manage a larger number of stock-keeping units, with fewer errors. To fulfill such requirements, warehouses need to transform into intelligent, efficient and automated facilities. Digitisation is becoming a necessity. The future of warehouses, hence, will be determined by the '3S' principle: Smarter, Speedier and Sustainable.

Smarter - There are immense benefits associated with imaging, cloud integration, voice/face recognition and personal assistants. The advantage is that it offers real-time information, regardless of the environment and location.

Speedier - Robotics and other automated solutions can decrease the amount of time that personnel spend on travel. These reductions naturally lead to a boost in efficiency, simplification of manual tasks and lower costs. A shift to the Internet of Things (IoT) allows inventory management through the implementation of drones, automated guided vehicles that do not require any human interference. Inventory managers can make pre-emptive decisions and predict demand based on data.

Sustainable - It is now pivotal to integrate sustainability into the SOP. Designs that reduce carbon footprint are adopted and sustainable technology is incorporated, for businesses to operate more efficiently.

Welspun One Logistics Parks is expanding its footprint in different states in India. What kind of growth are you looking for in the coming years?

At Welspun One, our aim since day one has been to create a pan-India presence. With the launch of Fund I, which is a SEBI registered Category II AIF, the strategy was to acquire land parcels in high demand and develop Grade-A warehousing parks, which will be leased on a long-term basis to 'AAA' credit tenants from sectors such as e-commerce, FMCG, 3PL, pharma and auto-ancillaries. The AIF is a registered Category II AIF, India's first warehousing fund that provides domestic institutions, high net worth individuals, family offices, and non-resident Indians, an opportunity to invest in the warehousing and industrial real estate sector. We have successfully done that by working closely with government organisations both in North (Haryana) and South (Tamil Nadu) by signing MoUs that have helped us acquire land parcels in pre-identified markets.

To expand on our vision, we are opportunistically looking to expand our portfolio and plan to invest about Rs 2,000 crore to develop and lease a portfolio of 7-8 million sq ft of Grade-A warehousing spaces across India. Having pre-identified high-growth markets, the intent is to have discussions with landowners in tier-I cities including Mumbai, Pune, Bengaluru, Delhi and Kolkata to pick up land parcels ranging from 40-75 acres.

What opportunities do you foresee for your business? What is your market outlook on the logistics & warehousing?

From being largely unorganised to now being a key factor in the supply chain of a business, the warehousing market in India has evolved for the better. With favourable government policies along with the expansion of e-commerce business, the Indian warehousing market has projected great opportunities for investment catching the eyes of onshore and offshore investors.

From a developer perspective, warehousing construction has branched out based on the demand from investors. In-city warehousing, built-to-suit model, on demand warehousing etc. as concepts have picked up largely during the last couple of years. With e-commerce penetration in smaller cities, most firms choose to invest in smaller warehousing units that are closer to their demand zones. On the other hand, companies are looking for larger warehouses or Grade A that match global standards and are technologically advanced, being able to contribute and ease supply chain management.

Hits: 0