Cautiously optimistic!

In spite of the growing infrastructure and industrial developments in the region, the north real estate market looks at a cautiously optimistic future with a mix of opportunities and challenges. Construction Times finds out…

The real estate market in Delhi-NCR has seen exponential growth in the past couple of years. Last year has seen a turnaround with residential and commercial real estate markets poised for growth. According to the recent CBRE report on office spaces, Delhi-NCR are likely to dominate new completions. The ANAROCK Research reveals a vibrant residential real estate market in the NCR between 2018 till the Q1 2024. Residential real estate market in the region has grown in property rates and sales in the last two years due to demand surge. The trend is likely to continue this year as well. Developers are exhibiting a growing emphasis on building state-of-the-art facilities with amenities catering to the evolving requirements of modern businesses.

Emerging trends

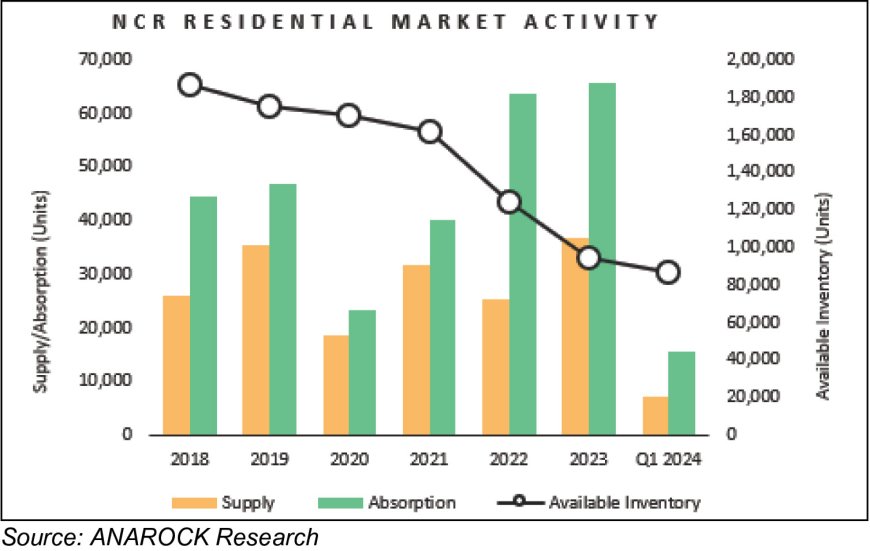

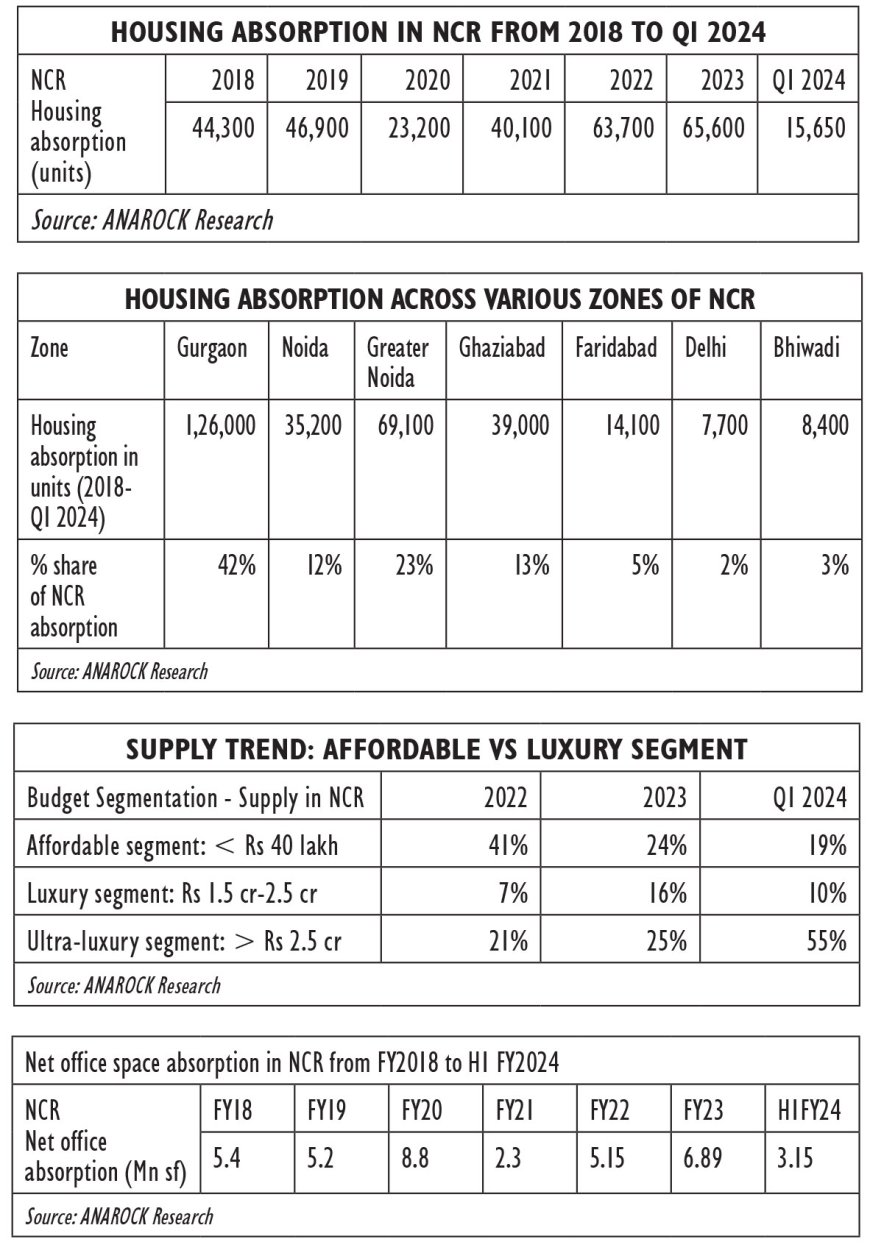

ANAROCK Research reveals that the residential real estate market in the NCR between 2018 and Q1 2024 has seen a vibrant performance. Nearly 1,80,900 units were launched, with robust demand leading to the absorption of 2,99,500 units. As of Q1 2024, approx. 86,400 units remain available. Significantly, 2023 saw record highs in both new supply and absorption of residential units within the timeframe analysed. This trend suggests a gradual return to pre-2016 levels, which marked the peak of activity in the NCR housing market.

The graph illustrates an increase in the supply of residential units alongside their absorption rate. Consequently, the amount of available inventory is steadily declining.

An in-depth analysis by ANAROCK reveals Gurugram and Greater Noida as key contributors, leading in both new housing supply and absorption. “Property prices across NCR have risen by 37% between Q1 2018 and Q1 2024, with Greater Noida witnessing the highest jump of 48%. The average property price in NCR now stands at Rs 6,200/sft,” says Prashant Thakur, Regional Director & Head – Research, ANARCK Group.

Buying trends

The residential market has seen some positive momentum in affordable housing in tier 2 cities while the demand for luxury housing in Delhi NCR is continuing to improve this year. According to Thakur, there’s a strong demand for affordable housing driven by a growing middle class, young professionals, and government initiatives like PMAY promoting homeownership among lower-income groups. Talking about the trend Thakur is of the view, “Due to past delays in project completions and the risk of unfinished projects, buyers in the NCR region increasingly prefer ready-to-move-in properties. Additionally, there has been a noticeable uptick in demand for larger homes or those with extra rooms that can double as office spaces.”

In the residential market, the affordable segment market share has seen a sharp drop in demand while luxury segment has seen some momentum, according to ANAROCK Group.

The launch of new affordable housing units (under Rs 40 lakh) has been shrinking. Their market share dropped from 41% in 2022 to 24% in 2023, and further down to 19% in the first quarter of 2024.

In contrast, luxury (Rs 1.5 cr-2.5 cr) and ultra-luxury (> Rs 2.5 cr) segments saw significant growth in their year-on-year (Y-o-Y) market share between 2022 and 2023. “The luxury segment new supply share grew by 9%, while the ultra-luxury segment’s share increased by 4%. Interestingly, the ultra-luxury segment has experienced a substantial surge in its share of new residential launches. The segment’s share skyrocketed from 21% in 2022 to a whopping 55% in Q1 2024,” highlights Thakur.

In the office market, the office leasing activity in NCR is steady and there’s a growing trend towards flexible workspaces, according to ANAROCK report. “The office space market is stable, with healthy leasing activity, particularly in Gurugram’s prime sub-markets like Cybercity and Golf Course Road,” says Thakur.

Looking at the new emerging trends in tier 2 cities, Anshuman Magazine,

The government's strategic focus on industrial corridors and improved internet access is igniting a surge in demand for industrial and logistics spaces in these regions. This, combined with the growing aspiration for homeownership, is propelling the residential sector forward, according to him.

Market outlook

“The future outlook for the NCR real estate market appears positive with continuous growth in infrastructure, an influx of global corporations setting up offices, and a stable demand for residential properties,” says Thakur. However, he cautions that the market's dynamics could shift with economic changes, interest rate fluctuations, environmental regulations and policy adjustments.

According to Magazine, the Northern region's real estate market presents a compelling picture – a blend of established metros flourishing alongside the rise of tier-II cities, all underpinned by strong fundamentals and a supportive business environment. This region is undoubtedly a market to watch in the years to come.

Overall, the north real estate market foresees a positive outlook on the general market trends in spite of some challenges in terms of project delays, inventory overhang and construction slowdowns.