INFRA INDUSTRY heading for a healthy growth

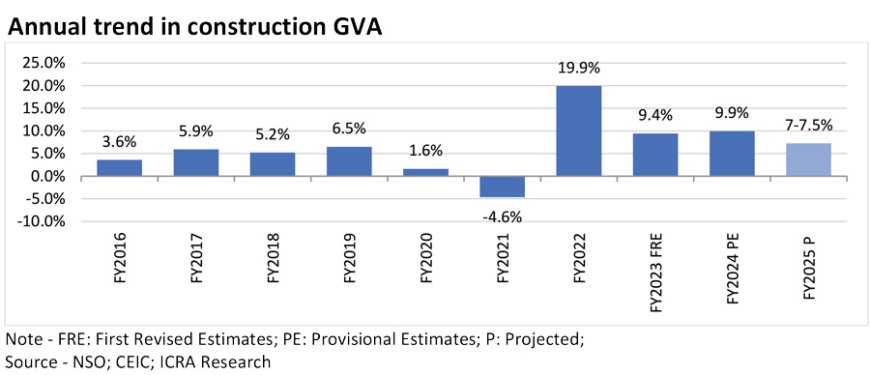

The construction gross value added (GVA) witnessed a year-on-year (YoY) growth of 9.9% in FY2024 provisional estimate (PE), driven by a healthy execution pace and moderation in raw material prices. ICRA expects the construction GVA to grow by 7.0-7.5% in FY2025. Although this is lower than the FY2024 level, it remains higher than the long-term CAGR of ~6.0% observed during FY2014-FY2024 PE, indicating favourable growth prospects for industry participants.

Bank credit to the construction sector increased by ~4.2% YoY in June 2024, primarily driven by elevated funding requirements to support the growing scale of operations and additional funding blocked in margin money due to increased bank guarantee (BG) requirements and retention money being withheld, as there were no further extensions in the Atmanirbhar Bharat scheme-related relaxations beyond March 2024.

Indian construction entities are expected to maintain a healthy revenue growth in FY2025e, with a projected YoY growth of 12-15%. This growth is aided by an adequate order book position, sustained pace of execution, and the Government’s thrust on infrastructure activity, as reflected in the increase in the Government of India’s total capital expenditure (capex) to Rs 11.1 trillion (+17.1% YoY) in the FY2025 Revised Budget Estimates (RBE). The aggregate order book-to-sales ratio for ICRA's sample set of companies remained stable at 3.3x as on June 2024, supported by diversification into segments such as drinking water, metro segment, or railway station development.

Roads, Railways account for 47% of total capital outlay during FY2025 RE

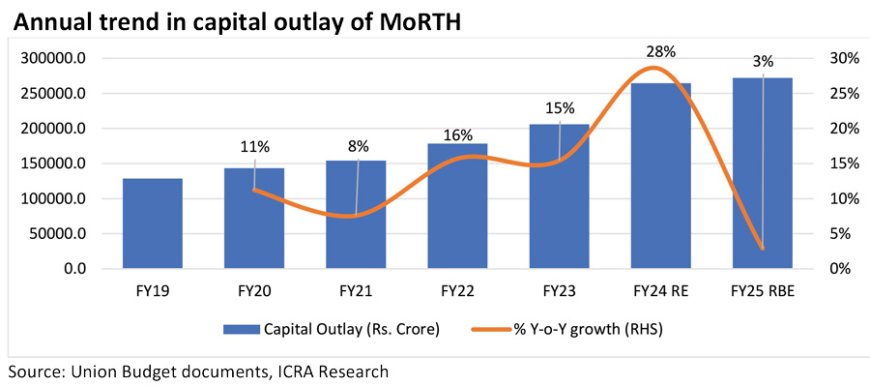

The Government’s capital outlay for the Ministry of Road Transport and Highways (MoRTH) rose to Rs. 2.72 trillion in FY2025 RBE from Rs. 1.29 trillion in FY2019. Further, MoRTH’s share in the total capex increased to 18.4% from 14.1% over this period. Although the capital outlay for MoRTH increased marginally by 2.9% in FY2025 RBE, it remains healthy, indicating the Government's focus on enabling the Ministry to meet its completion targets for the Bharatmala Pariyojana and the National Infrastructure Pipeline. Additionally, with the Government emphasising the revival of private investment in the sector through the BOT-Toll route, overall capex in the sector is expected to be higher going forward.

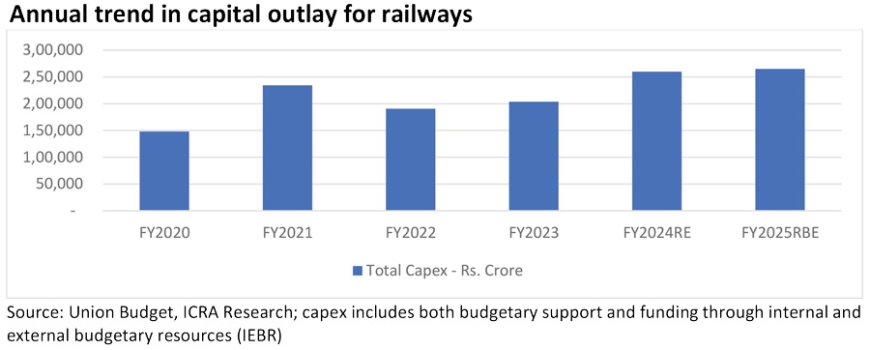

Indian Railways has been undertaking sizeable capex over the years towards maintenance, upgradation, and modernisation of the railway infrastructure, as well as adopting new technology and high-speed trains. The capex for railways has increased at a CAGR of 12.4% over FY2020-FY2025 RBE to Rs. 2.65 lakh crore.

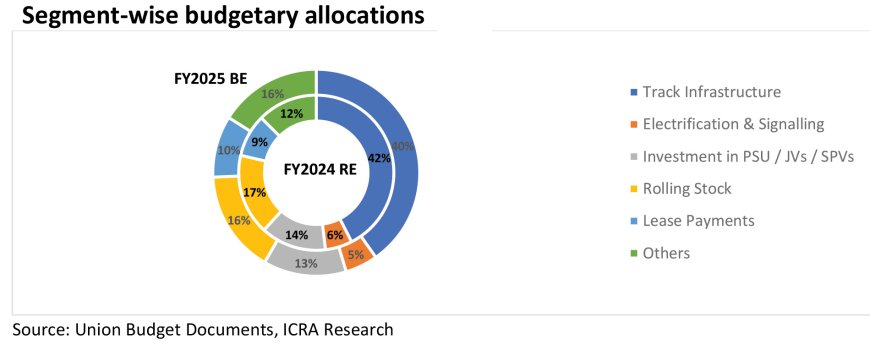

The capital outlay for Railways (excluding IEBR) has been increased by 5.0% YoY to Rs. 2.52 trillion in FY2025 RBE compared to a 50.7% YoY increase in FY2024 RE, which was driven by a significant YoY rise of 32.4% in track infrastructure. The allocation proportions have largely remained the same in FY2025 RBE compared to FY2024 RE, with track infrastructure and rolling stock comprising 56% of the budget, while investment in PSUs, JVs, and SPVs accounts for 13% of the overall budget outlay.

The construction cost for metro projects is estimated at Rs. 90-120 crore per kilometre (km) for at-grade metro, while it is significantly higher for the elevated and underground metro (Rs. 300-400 crore/km) projects. Further, although the metro rail system is emerging as a dependable and cost-effective mobility solution for the masses, last-mile connectivity remains a challenge for achieving optimal ridership.

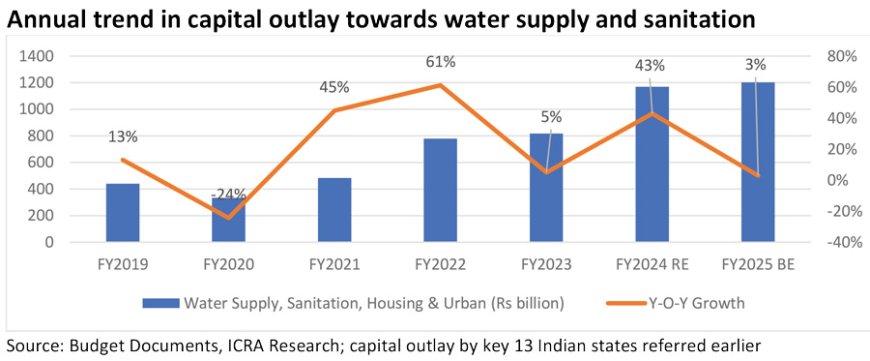

Water supply and sanitation

The capital outlay by 13 key Indian states towards water supply, sanitation, housing, and urban development rose at a robust CAGR of 18.2% during FY2019-FY2025 BE and is estimated to remain healthy, as is evident from the 8.8% budgeted increase in total capital outlay for FY2025 BE over FY2024 RE. EPC entities have witnessed strong order inflow in the water and sanitation segment in the backdrop of the Central Government’s ambitious schemes like Har Ghar Jal under JJM, sewage treatment under the National Mission for Clean Ganga scheme, and the Atal Mission for Rejuvenation and Urban Transformation (AMRUT). Companies operating in the water and sanitation segment are likely to witness healthy revenue growth in the medium term. Unlike other infrastructure segments like road/building projects, fewer entities possess the requisite technical eligibility to bid for large water supply and sewage projects, which ensures relatively moderate competition in the water segment.

Key challenges

Intense competition: Among the key infrastructure sub-segments, the National Highways Authority of India EPC segment continues to witness the highest competitive intensity. The maximum discount quoted on bid prices has consistently increased since FY2021, reaching 66% in FY2024 compared to 31% in FY2021. The competitive intensity is relatively moderate in segments, such as metro railway as well as sewage and drinking water, with ~4-8 bidders per contract in each of these segments.

Volatility in key commodities: The moderation in prices of key commodities such as steel augured well for construction entities and supported their earnings profiles in FY2024. However, steel prices have started inching upwards and could have a bearing on the profitability in FY2025.

Heightened working capital requirements: The cash conversion cycle is expected

to be elongated with the expiration of the relaxations under the Atmanirbhar Bharat scheme in March 2024. Such factors are anticipated to increase the working

capital intensity from the current levels

in FY2025.

Risk of double leveraging: Given the increasing competition in the EPC space, a sizeable number of contractors are taking up development projects, thus entailing higher equity commitments. In the absence of commensurate fund generation, few entities have started taking debt to fund their equity commitments, thus exposing them to the risk of double leveraging.

|

Chintan Dilip Lakhani ICRA Limited |