Cummins Has Developed Fuel-Agnostic Internal Combustion Engines With Wide Fuel Options.

Nitin Jirafe

Engine Business Leader, Cummins India

How do you view the latest developments in the commercial vehicle market in India?

Since 2020, the Indian domestic Medium and Heavy Commercial Vehicle (M&HCV) industry has been on a robust growth trajectory aiming to recover the momentum lost during the COVID-19 pandemic. The industry’s performance for the first nine months of the current calendar year has been impressive, recording a substantial 16% y-o-y growth. It is now expected to reach the previous peak volumes witnessed in 2018.

This remarkable growth is driven by strong economic activity, government investment in infrastructure along with strong growth in the e-commerce industry. Further, the industry has also benefitted from the replacement demand of high volumes sold during 2018, as large operators typically operate on a 5-6 years of ownership cycle.

With the implementation of BS VI OBD I emission standards in 2020, India is now at par with Europe’s equivalent Euro VI emission limits. Furthermore, the implementation of OBD II norms in India from April 2023 has ensured tighter compliance through the real duty cycle. Similarly, enforcement of mandatory Anti-lock Braking System (ABS) norms and upcoming AC cabin norms from 2025, along with OEMs offering optional Advanced Driver-Assistance System (ADAS) features would help to enhance safety and comfort for the vehicles and drivers.

How do you compare the market trends for trucks and buses?

The truck and bus segment of the commercial vehicle industry caters to different needs, reflecting the diverse demands of freight movement and human mobility. While truck demand is correlated to economic activity, bus demand is driven by the movement of school children, office staff, and other people using public transport.

Following a robust resurgence in economic growth after 2020, the truck demand has experienced a sharp. In contrast, the demand

for buses took longer to recover due to work-from-home policies, remote operations of schools, and avoidance of public transport. This shift was reflected in the contribution of buses which is typically ~10% of the overall medium and heavy commercial vehicles sold in India, which dropped to ~4% in FY21 and FY22. However, since then, the recovery for buses has returned to normal levels and is currently on a strong growth path.

Trucks and buses are also expected to have a different path for decarbonization and have seen a varied level of adoption.

Battery electric technology has found viability for buses given their limited operational range within the city and dedicated routes. With the support of government funding, electric buses have taken the lead with ~5% of all buses sold in 2023 being electric. With a strong order pipeline, the momentum is expected to continue.

However, trucks hauling heavy loads, plying across the length and breadth of the country with no fixed routes face challenges in adopting battery-electric solutions. These challenges impact key operational parameters of payload, range, and charging time. In our view, the transition to zero-emission for trucks would be through low-emission fuels.

How is Cummins powering the commercial vehicles in India?

In India, over the last three decades, we have successfully leveraged our extensive, global experience in low emissions technologies for combustion, fuel systems, electronic controls, turbocharging, exhaust aftertreatment, and filtration. With an unwavering focus on innovation and dependability, Cummins India has consistently delivered market-leading engine technology with the mantra of ‘JO SARAL WOH SAFAL’ (which translates into class-leading yet simple technology from Cummins to ensure success for our customers). Currently, more than three lakh Cummins BSVI engine-powered commercial vehicles are plying on Indian roads offering superior performance, best-in-class fuel efficiency, maximum payload, and competitive maintenance cost – resulting in an exceptional Total Cost of Ownership.

Our commitment to excellence is strongly backed by our extensive, pan-India distribution network of dealers, a team of 200+ service engineers, more than 230 Component Care Centers, QR-code-based MITWA Mechanic Loyalty program through the Saathi mobile app, and the assurance of Genuine Cummins Parts. To further aid the understanding and adoption of newer technologies, Cummins has successfully trained and educated more than 25,000 dealer technicians, drivers, bodybuilders, and OEM plant quality and service teams.

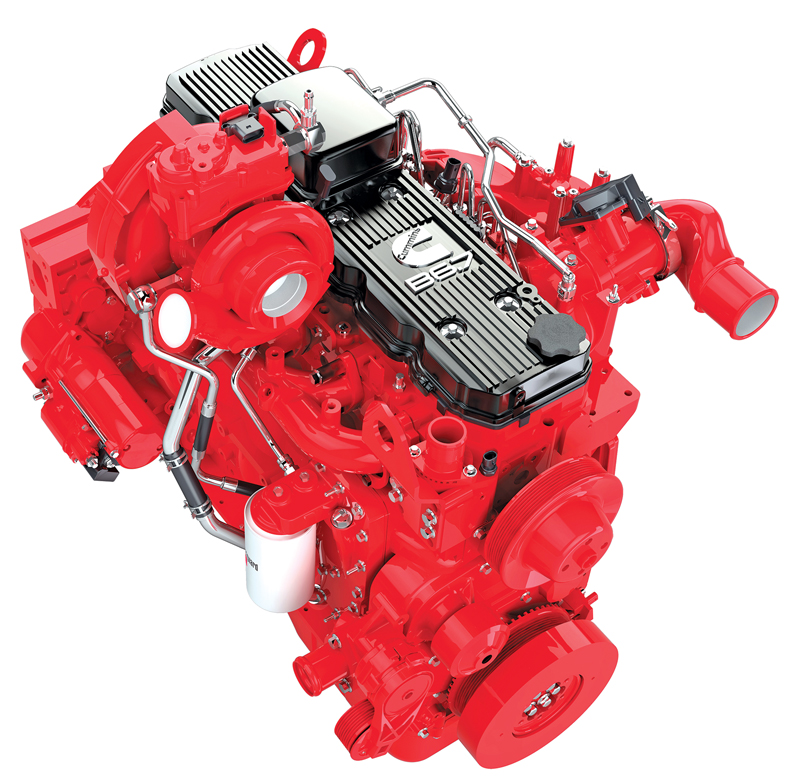

Additionally, Cummins is working to develop fuel-agnostic engine technology to reduce its carbon footprint and provide a platform with minimal change with multi-fuel options.

What kind of efficiency and productivity solutions are offered by Cummins for the present and future needs of CVs?

Logistics costs in India are often touted to be high at ~12-14% of GDP. The country has traditionally faced inefficiencies in its logistics operations resulting from higher fuel consumption and lower daily truck running estimated at 300-350 km/day compared to ~500-700 km/day in countries like the US, Europe, and China.

Recognizing these inefficiencies, the country is investing heavily in developing its highway and expressway infrastructure while also focusing on regulations to enhance fuel efficiencies.

How is Cummins preparing for the sustainable and digital future of CVs?

India’s rapid infrastructure development is a critical driver of the country’s growth. However, this development must be done responsibly considering the existential crisis posed by climate change. Two key areas that support these infrastructure trends are – Decarbonization and Digitization. While adopting new low and zero-carbon powertrain technologies would support decarbonization, digitization can disrupt how these products are used, maintained, and delivered efficiently.

Cummins’ Destination ZeroTM strategy offers multiple paths to decarbonization, with immediate reductions where possible. Following this, Cummins has developed fuel-agnostic internal combustion engines with wide fuel options from advanced diesel to low and zero-carbon fuels like CNG/LNG/Bio-CNG and H2; and zero-emissions solutions with fuel cell and battery electric systems.

Cummins’ new electronic engines are integrated with Cummins Telematics offerings and include capabilities that help in the diagnosis, repair, and prediction of potential faults. This will significantly improve vehicle uptime, improve performance, and overall customer satisfaction.

Under connected solutions, Cummins is actively developing connected diagnostics that can provide notifications on engine faults and their most likely root cause(s), engine prognostics that can predict failures in advance, and remotely connected software updates, which reduces time to deploy engine enhancement features, downtime and also allow for remote adjustments of engine settings to optimi