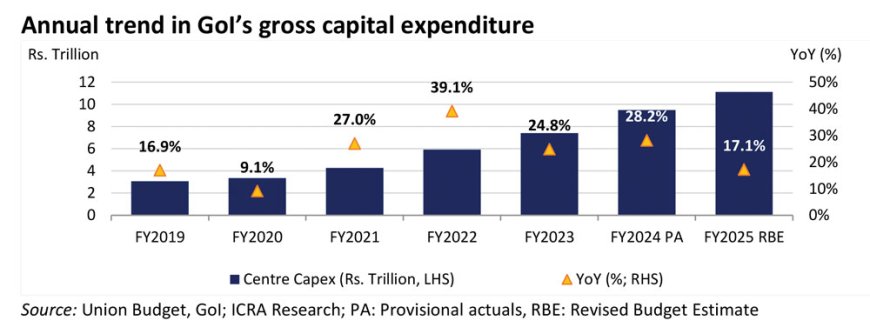

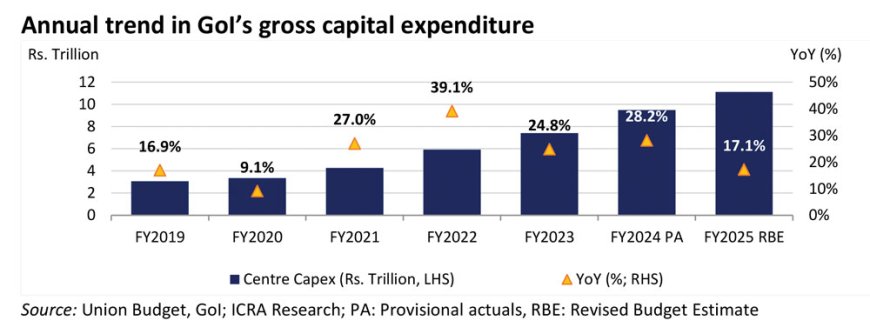

The Indian infrastructure sector is poised to sustain its healthy growth momentum over the medium term, supported by healthy capex outlay across various infrastructure sub-segments. The Government of India’s (GoI) gross capital outlay at Rs. 11.1 trillion in FY2025 RBE entails a YoY growth of 17.1% over Rs. 9.5 trillion, recorded in the FY2024 PA, while trailing the expansion of over 20% seen in each of the post-Covid years. The GoI’s capex allocations towards the major ministries (roads, and railways contributes to over 45% of total capex outlay for FY2025 RBE) exceed the year-ago levels; this includes roads (Rs. 2.7 trillion; YoY: +3.2% over FY2024 PA), and railways (Rs. 2.5 trillion; +3.9%).

The capital expenditure from the Government, however, witnessed a decline of 14.7% during April-October FY2025. A stellar 60.5% growth is required in November-March FY2025 to meet the overall capital outlay target of Rs 11.1 trillion. ICRA expects a strong ramp-up in capital outlay during H2, which will aid revenue growth for construction entities. However, the capex target of Rs. 11.1 trillion for FY2025 is likely to be missed by a margin of at least Rs. 1.0 trillion.

Sector wise trend

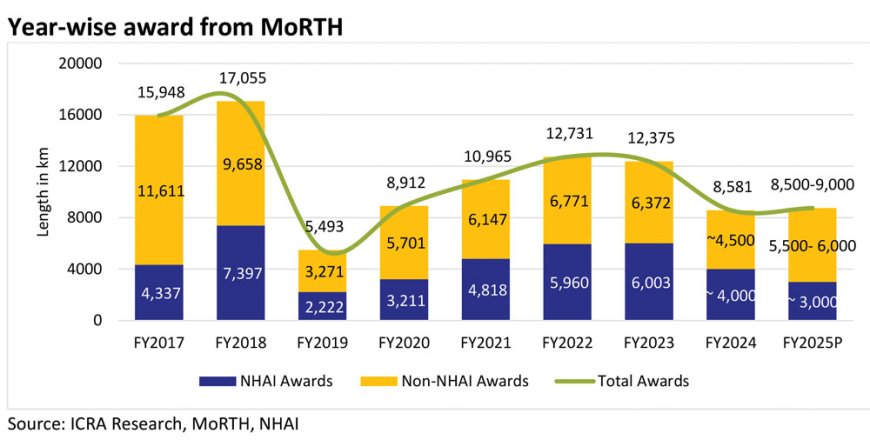

Road Sector – Project awarding activity slowed down in FY2025: The pace of road execution improved by ~20% in FY2024 to 12,349 km from 10,331 km in FY2023 owing to the Government’s focus on execution and higher allocation to the Road Ministry. However, the execution has declined by 9% to 4,761 km in 8M FY2025 from 5,248 km in 8M FY2024 on account of the slowdown in construction activity due to the General Elections in Q1 FY2025 and higher-than-average rainfall across the country in Q2 FY2025.

Despite this, ICRA expects the road execution to pick up in the rest of the fiscal with construction in the range of 10,000-10,500 km (~27-29 km/day) in FY2025 (a marginal decline from FY2024). Despite the muted YoY trend for road construction in terms of km/day, the increasing share of 4-lanes, 6-lanes, and 8-lanes in project awards will result in healthy YoY growth in terms of lane-km.

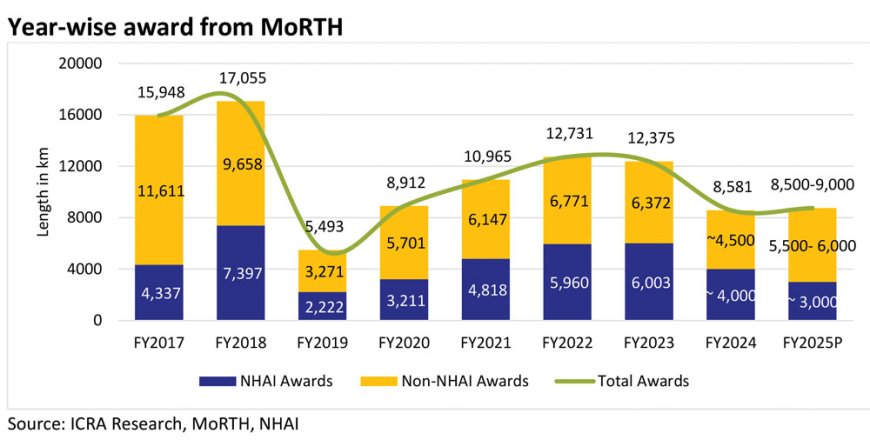

The awarding of road projects declined by 31% to 8,581 km in FY2024 amid the delay in approval from the Cabinet for revised cost estimates of Bharatmala Pariyojana (BMP) Phase-1. Further, the awarding activity declined by 20% to ~2,250 km in 8M FY2025 over 2,816 km in 8M FY2024, on account of the Model Code of Conduct, which ended on June 6, 2024, coupled with restrictions on project awards due to pending Cabinet approval. Nevertheless, with the Ministry’s approval on project awards in August 2024, ICRA expects the same to pick up from H2, and remain at 8,500-9,000 km in FY2025, similar to 8,581 km in FY2024. Some states like Maharashtra awarded multiple road projects in the current fiscal, which provided some support to the order book of road contractors.

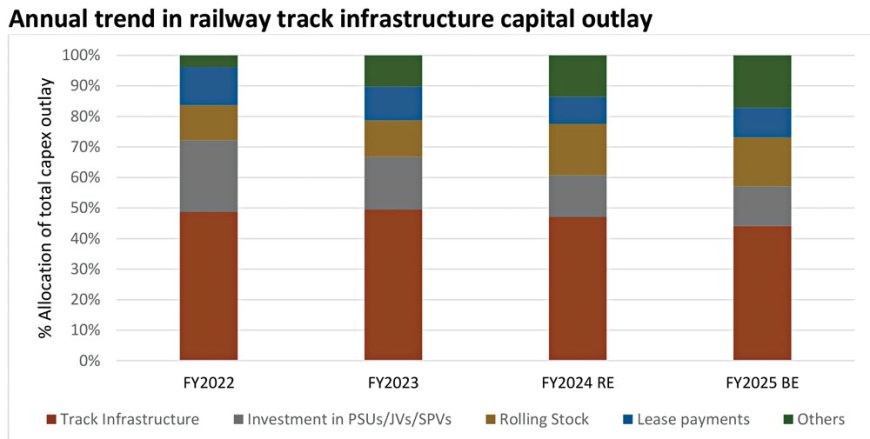

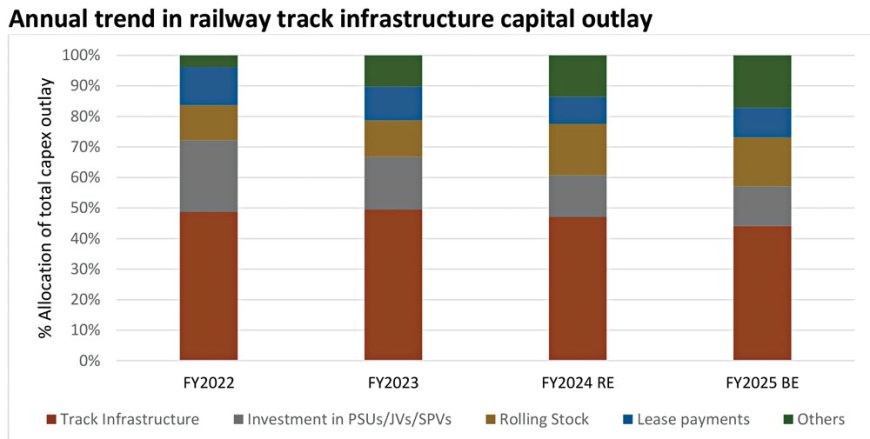

Railways sector: Indian Railways has been undertaking sizeable capital expenditure over the years towards maintenance, upgradation and modernisation of the railway infrastructure, as well as adopting new technology and high-speed trains. The overall railways capital outlay has been on an increasing trend over the years with the same reaching Rs. 2.65 trillion (including internal and extra Budgetary allocation) in FY2025 BE. Although the YoY growth is modest at 2%, it has expanded by 80% in the last five years, indicating the Government’s focus on the railway sector. Further, the growth enables the ministry to meet the sizeable targets under the National Infrastructure Pipeline (NIP).

Historically, track-infrastructure accounted for a major share of the capital outlay; however, the investments in rolling stock and modernising railway stations (classified under others) have also witnessed a handsome growth in recent years.

Challenges plaguing the construction sector

A major challenge the construction industry is grappling with is intense competitive intensity, especially among the Central Government projects. Due to relatively higher counter-party risk associated with state and private sector compared to the Centre, many entities continue to aggressively bid for Central Government projects. Consequently, with increased competition, most bidders quote lower than the base price, resulting in winning bids at significant discounts. Among the key infrastructure segments, the roads (EPC) sector continues to witness the highest competitive intensity.

Given the slowdown in project-awarding activity, the road sector will continue to see aggressive competition from the industry participants in the near to medium term. Competition has also gradually caught up in Metro, Railways and Water Supply & Sanitation (WSS) as well; however, the bidding discipline remains better than that in the road segment. The WSS segment is likely to witness heightened competition with more EPC players trying out diversification with a favourable

track record of payments in this segment (especially for projects under the Jal Jeevan Mission).

Outlook on the sector

The Model Code of Conduct in Q1 FY2025 and an elongated monsoon period in Q2 FY2025 hampered construction activity, as is reflected in the modest revenue growth of ICRA's sample set of companies at ~1.5% during H1 FY2025. However, the execution pace is estimated to pick up in H2 FY2025 and operating income is likely to grow in the range of 8-10% in FY2025, aided by an adequate order book position. The aggregate order book-to-sales (OB/OI, based on FY2024 numbers) ratio is expected to moderate to 2.8-3.0 times by March 2025, from ~3.5 levels as on March 2024.

While intense competition continues to remain a drag on profitability, relatively stable commodity prices and healthy revenue growth expectations will keep the operating margins range-bound at around 10.5%-11.0% in FY2025e.

While debt levels are expected to increase to support the higher working capital requirements, the corresponding operational leverage benefits are anticipated to keep the interest cover at adequate level of around

3.6-3.9 times in FY2025e.

The outlook on the sector continues to be Stable, driven by expectations of steady growth in operating income, moderate leverage and comfortable coverage metrics.

Suprio Banerjee

Vice President and & Co-Group Head – Corporate Ratings, ICRA