Emerging trends in ROADS & HIGHWAYS

Road construction is expected to jump by 15-20% in FY2023, supported by strong unexecuted pipeline. The capital spending of MoRTH has increased by more than nine times to Rs 1.87 lakh crore in FY2023BE from Rs 19,398 crore in FY2013, translating a CAGR of 25%. Significant impetus given by the government on improving road infrastructure

Road construction is expected to jump by 15-20% in FY2023, supported by strong unexecuted pipeline.

The capital spending of MoRTH has increased by more than nine times to Rs 1.87 lakh crore in FY2023BE from Rs 19,398 crore in FY2013, translating a CAGR of 25%. Significant impetus given by the government on improving road infrastructure has resulted in steady improvement in road project awards as well as road construction over the years. The pace of execution was relatively subdued in FY2022 owing to the prolonged monsoons which has affected the productive days for an extended period, especially during the second half of fiscal which is traditionally peak working season. In FY2022, per day execution declined by ~22% to 10,457 km/day vis-à-vis execution of 13,327 km/day in FY2021. Given the strong unexecuted pipeline, continued relaxations in terms of monthly payments and lower retention amount requirements, the execution is expected to improve to 12,000-12,500 km per day for FY2023.

Opportunities in roads

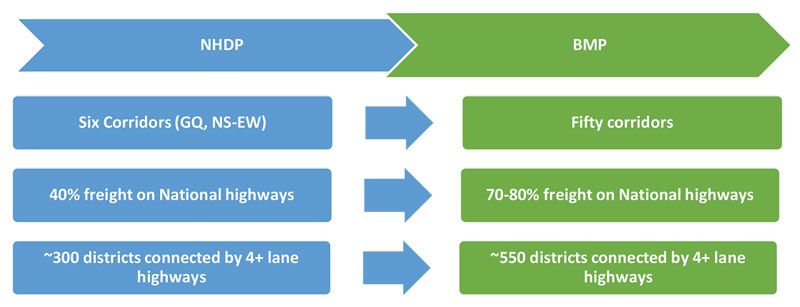

ICRA analysis suggests that Bharatmala Pariyojana (BMP) announced by the government in 2015 and approved by the Cabinet Committee on Economic Affair (CCEA) in Oct. 2017 has accelerated the investments in the road sector. BMP phase-I envisaged development of 24,800 km national highways and residual 10,000 km of highways pending under erstwhile National Highway Development Program (NHDP) by FY2022, at an estimated outlay of Rs. 5.35 lakh crore translating to cost per km of Rs.15.52 crore. As per the initial plan, this was planned to be incurred during the five-year period between 2017-2022, though it is now likely to be delayed by six years and is expected to be completed by FY2028.

| S.No. | Classification | Total Length (KM) | Phase I (KM) |

| 1 | Economic Corridors | 26,160 | 9,000 |

| 2 | Inter-corridor Roads & Feeder Roads | 15,400 | 6,000 |

| 3 | National Corridor Efficiency Program | 13,049 | 5,000 |

| 4 | Border & International Connectivity Roads | 5,198 | 2,000 |

| 5 | Coastal & Port Connectivity Roads | 3,298 | 2,000 |

| 6 | Expressways | 1,837 | 800 |

| BM Total | 64,942 | 24,800 | |

| Residual NHDP | 10,000 | ||

| BM + NHDP | 34,800 |

The objective of the programme is optimal resource allocation for a holistic highway development/improvement initiative to re-define road development and have a macro approach while planning expansion of the national highways network. To achieve this, the national highways are categorised into national corridors, economic corridors and inter-corridors. Additional emphasis is also laid on feeder routes to address first and last mile connectivity challenges.

BMP is implemented by three agencies, namely, the National Highways Authority of India (NHAI), Ministry of Road Transport & Highways (MoRTH), and the National Highways & Infrastructure Development Corporation Limited (NHIDCL). NHAI has a mandate to develop 22,660 km out of the 24,800 km length to be developed under the BMP phase-I.

Cost overruns in BMP

The estimated project cost for completion of BMP almost doubled to Rs. 10.64 lakh crore primarily due to increase in land acquisition costs and steep rise in input costs. Further, average cost of award stood at Rs. 31.6 crore per km which is 103% higher than initial estimated cost of Rs.15.52 crore per km. The final completion cost could be higher by at least 15-20% given the impact of rise in commodity prices on construction cost.

In terms of progress, around 60% of BMP phase I (20,632 km) was awarded till December 2021. Moreover, ~23% (8,134km out of 34,800 km) of road length has already been constructed till March 2022.

BMP witnessed the highest award of 7,396 km in FY2018, after which the awarding activity slowed down. Awarding activity was rather muted in FY2019, compared to the previous years, at 2,222 km due to general elections in FY2019. Post this, the awarding activity by NHAI improved in the last three years to 3,211 km in FY2021, 4,818 km for FY2021 and estimated at 5,500 km for FY2022. The awarding activity has been slow in the past four years on account of challenges faced in land acquisition while COVID-19 outbreak impacted the awarding activity in the last two years.

| Initial

Estimates |

Status as of Dec-2021 | |||||||

| Classification | Awarded &Approved | Balance for Award | Total | |||||

| Length | Cost | Length | Cost | Length | Cost | Length | Cost | |

| Economic Corridors | 9,000 | 120,000 | 6,123 | 2,04,223 | 4,613 | 1,53,468 | 10,736 | 3,57,692 |

| Inter-corridor Roads | 6,000 | 80,000 | 2,165 | 46,611 | 2,032 | 41,523 | 4,197 | 88,134 |

| Feeder Roads | 609 | 21,136 | 930 | 16,993 | 1,539 | 38,128 | ||

| National Corridor | 5,000 | 100,000 | 1,709 | 60,542 | 132 | 7,457 | 1,841 | 67,999 |

| National Corridor Efficiency Program | 738 | 37,241 | 531 | 15,206 | 1,270 | 52,447 | ||

| Border Roads | 2,000 | 25,000 | 1,350 | 8,871 | 54 | 277 | 1,404 | 9,148 |

| International Connectivity Roads | 80 | 2,556 | - | - | 80 | 2,556 | ||

| Coastal Roads | 2,000 | 20,000 | 77 | 1,171 | 606 | 14,927 | 683 | 16,099 |

| Port Connectivity | 174 | 1,351 | 469 | 12,098 | 643 | 13,449 | ||

| Expressways | 800 | 40,000 | 2,322 | 1,50,074 | 86 | 7,727 | 2,409 | 1,57,801 |

| BM Total | 24,800 | 385,000 | 15,347 | 5,33,776 | 9,453 | 2,69,676 | 24,800 | 8,03,452 |

| Residual NHDP | 10,000 | 150,000 | 5,285 | 1,17,911 | 4,714 | 1,42,334 | 10,000 | 2,60,245 |

| BM + NHDP | 34,800 | 535,000 | 20,632 | 6,51,687 | 14,167 | 4,12,010 | 34,800 | 10,63,967 |

Source: 374threport on demand for grants of MoRTH by standing committee on transport, tourism and culture; Length in km and Cost in Rs crore

Timelines for completion of BMP awards and execution

Assuming yearly NHAI awards of ~6,000-6,500 km in FY2023, the awarding activity under BMP is expected to be completed by FY2024. However, any significant decline in awarding in FY2024 as observed in FY2019, being an election year, may push award completion to FY2025. Assuming an annual execution of ~4,500-5,000 km from FY2023 onwards, the BMP programme is expected to be completed in FY2028, a delay of six years from the initial envisaged completion date of FY2022.

In terms of cost, projects worth Rs. 4.12 lakh crore are yet to be awarded which would result in sizeable opportunities for the road developers in the medium term. HAM and EPC together accounted for majority of the NHAI awards in the past five years while BOT awards accounted for less than 5% of the orders during this period and are expected to remain at similar levels in FY2023. The attractiveness of the HAM projects for road developers has resulted in a higher mix of HAM awards over the past two years and is expected to remain the mainstay going forward in NHAI awards.

Vinay Kumar G

Sector Head & Assistant Vice President, ICRA

Hits: 0